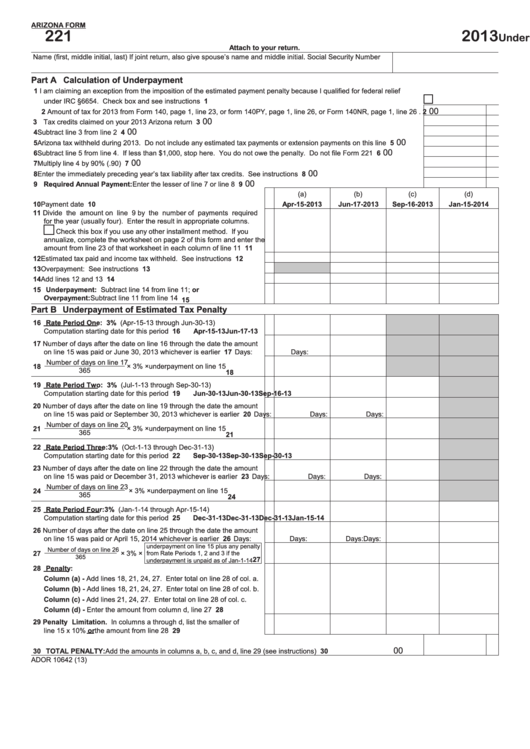

ARIZONA FORM

221

2013

Underpayment of Estimated Tax by Individuals

Attach to your return.

Name (first, middle initial, last) If joint return, also give spouse’s name and middle initial.

Social Security Number

Part A Calculation of Underpayment

1 I am claiming an exception from the imposition of the estimated payment penalty because I qualified for federal relief

under IRC §6654. Check box and see instructions ..............................................................................................................

1

00

2 Amount of tax for 2013 from Form 140, page 1, line 23, or form 140PY, page 1, line 26, or Form 140NR, page 1, line 26 .

2

00

3 Tax credits claimed on your 2013 Arizona return ..................................................................................................................

3

00

4 Subtract line 3 from line 2 .....................................................................................................................................................

4

00

5 Arizona tax withheld during 2013. Do not include any estimated tax payments or extension payments on this line ...........

5

00

6 Subtract line 5 from line 4. If less than $1,000, stop here. You do not owe the penalty. Do not file Form 221 ..................

6

00

7 Multiply line 4 by 90% (.90) ...................................................................................................................................................

7

00

8 Enter the immediately preceding year’s tax liability after tax credits. See instructions ........................................................

8

00

9 Required Annual Payment: Enter the lesser of line 7 or line 8 ..........................................................................................

9

(a)

(b)

(c)

(d)

10 Payment date .......................................................................................... 10

Apr-15-2013

Jun-17-2013

Sep-16-2013

Jan-15-2014

11 Divide the amount on line 9 by the number of payments required

for the year (usually four). Enter the result in appropriate columns.

Check this box if you use any other installment method. If you

annualize, complete the worksheet on page 2 of this form and enter the

amount from line 23 of that worksheet in each column of line 11 ........... 11

12 Estimated tax paid and income tax withheld. See instructions .............. 12

13 Overpayment: See instructions .............................................................. 13

14 Add lines 12 and 13 ................................................................................ 14

15 Underpayment: Subtract line 14 from line 11; or

Overpayment: Subtract line 11 from line 14 ......................................... 15

Part B Underpayment of Estimated Tax Penalty

16 Rate Period One: 3% (Apr-15-13 through Jun-30-13)

Computation starting date for this period ................................................ 16

Apr-15-13

Jun-17-13

17 Number of days after the date on line 16 through the date the amount

on line 15 was paid or June 30, 2013 whichever is earlier ..................... 17 Days:

Days:

Number of days on line 17

18

× 3% × underpayment on line 15

365

18

19 Rate Period Two: 3% (Jul-1-13 through Sep-30-13)

Computation starting date for this period ................................................ 19

Jun-30-13

Jun-30-13

Sep-16-13

20 Number of days after the date on line 19 through the date the amount

on line 15 was paid or September 30, 2013 whichever is earlier ............ 20 Days:

Days:

Days:

Number of days on line 20

21

× 3% × underpayment on line 15

365

21

22 Rate Period Three: 3% (Oct-1-13 through Dec-31-13)

Computation starting date for this period ................................................ 22

Sep-30-13

Sep-30-13

Sep-30-13

23 Number of days after the date on line 22 through the date the amount

on line 15 was paid or December 31, 2013 whichever is earlier ............. 23 Days:

Days:

Days:

Number of days on line 23

24

× 3% × underpayment on line 15

365

24

25 Rate Period Four: 3% (Jan-1-14 through Apr-15-14)

Computation starting date for this period ................................................ 25

Dec-31-13

Dec-31-13

Dec-31-13

Jan-15-14

26 Number of days after the date on line 25 through the date the amount

on line 15 was paid or April 15, 2014 whichever is earlier ...................... 26 Days:

Days:

Days:

Days:

underpayment on line 15 plus any penalty

Number of days on line 26

27

× 3% ×

from Rate Periods 1, 2 and 3 if the

365

27

underpayment is unpaid as of Jan-1-14

28 Penalty:

Column (a) - Add lines 18, 21, 24, 27. Enter total on line 28 of col. a.

Column (b) - Add lines 18, 21, 24, 27. Enter total on line 28 of col. b.

Column (c) - Add lines 21, 24, 27. Enter total on line 28 of col. c.

Column (d) - Enter the amount from column d, line 27 .......................... 28

29 Penalty Limitation.

In columns a through d, list the smaller of

line 15 x 10% or the amount from line 28 ............................................... 29

00

30 TOTAL PEnALTy: Add the amounts in columns a, b, c, and d, line 29 (see instructions) ................................................. 30

ADOR 10642 (13)

1

1 2

2