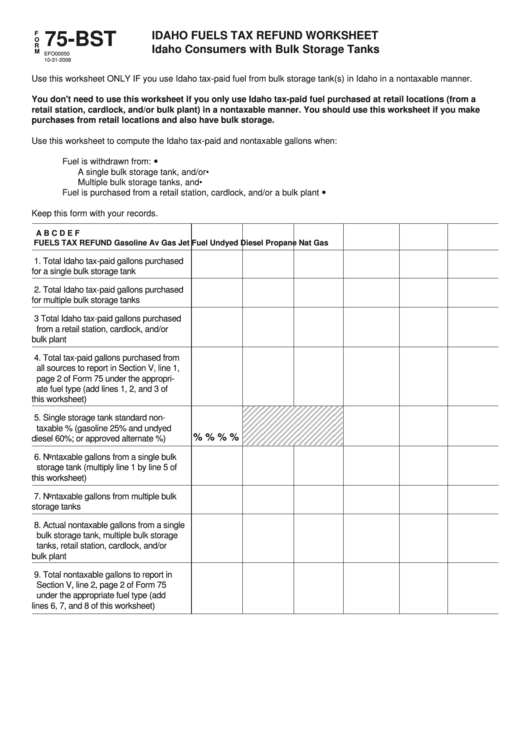

Form 75-Bst - Idaho Fuels Tax Refund Worksheet Idaho Consumers With Bulk Storage Tanks -2008

ADVERTISEMENT

F

75-BsT

IDAhO FuEls TAx REFunD WORkshEET

O

R

Idaho Consumers with Bulk storage Tanks

M

EFO00050

10-31-2008

Use this worksheet ONLY IF you use Idaho tax-paid fuel from bulk storage tank(s) in Idaho in a nontaxable manner.

You don't need to use this worksheet if you only use Idaho tax-paid fuel purchased at retail locations (from a

retail station, cardlock, and/or bulk plant) in a nontaxable manner. You should use this worksheet if you make

purchases from retail locations and also have bulk storage.

Use this worksheet to compute the Idaho tax-paid and nontaxable gallons when:

y

Fuel is withdrawn from:

•

A single bulk storage tank, and/or

•

Multiple bulk storage tanks, and

y

Fuel is purchased from a retail station, cardlock, and/or a bulk plant

Keep this form with your records.

A

B

C

D

E

F

FuEls TAx REFunD

Gasoline

Av Gas

Jet Fuel

undyed Diesel Propane

nat Gas

1. Total Idaho tax-paid gallons purchased

for a single bulk storage tank ..................

2. Total Idaho tax-paid gallons purchased

for multiple bulk storage tanks ................

3 Total Idaho tax-paid gallons purchased

from a retail station, cardlock, and/or

bulk plant .................................................

4. Total tax-paid gallons purchased from

all sources to report in Section V, line 1,

page 2 of Form 75 under the appropri-

ate fuel type (add lines 1, 2, and 3 of

this worksheet) ........................................

5. Single storage tank standard non-

taxable % (gasoline 25% and undyed

%

%

%

%

diesel 60%; or approved alternate %) ....

6. Nontaxable gallons from a single bulk

storage tank (multiply line 1 by line 5 of

this worksheet) ........................................

7. Nontaxable gallons from multiple bulk

storage tanks ...........................................

8. Actual nontaxable gallons from a single

bulk storage tank, multiple bulk storage

tanks, retail station, cardlock, and/or

bulk plant .................................................

9. Total nontaxable gallons to report in

Section V, line 2, page 2 of Form 75

under the appropriate fuel type (add

lines 6, 7, and 8 of this worksheet) .........

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2