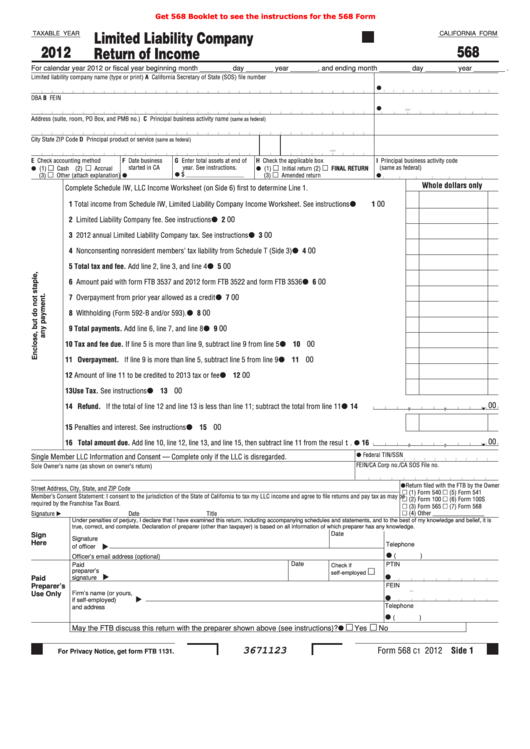

Get 568 Booklet to see the instructions for the 568 Form

Limited Liability Company

TAXABLE YEAR

CALIFORNIA FORM

2012

568

Return of Income

For calendar year 2012 or fiscal year beginning month ________ day _______ year _______, and ending month ________ day ________ year ________ .

Limited liability company name (type or print)

A California Secretary of State (SOS) file number

.

DBA

B FEIN

Address (suite, room, PO Box, and PMB no.)

C Principal business activity name

(same as federal)

City

State

ZIP Code

D Principal product or service

(same as federal)

E Check accounting method

F Date business

G Enter total assets at end of

H Check the applicable box

I Principal business activity code

started in CA

year. See instructions.

(same as federal)

(1)

Cash (2)

Accrual

(1)

Initial return (2)

FINAL RETURN

.$ ___________________

(3)

Other (attach explanation)

(3)

Amended return

Whole dollars only

Complete Schedule IW, LLC Income Worksheet (on Side 6) first to determine Line 1.

I

00

1 Total income from Schedule IW, Limited Liability Company Income Worksheet. See instructions . . . . . . . . . . .

1

I

00

2 Limited Liability Company fee. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

I

00

3 2012 annual Limited Liability Company tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

I

00

4 Nonconsenting nonresident members’ tax liability from Schedule T (Side 3) . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

I

00

5 Total tax and fee. Add line 2, line 3, and line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

I

00

6 Amount paid with form FTB 3537 and 2012 form FTB 3522 and form FTB 3536 . . . . . . . . . . . . . . . . . . . . . . . .

6

I

7 Overpayment from prior year allowed as a credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

I

00

8 Withholding (Form 592-B and/or 593). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

I

9 Total payments. Add line 6, line 7, and line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

I

00

10 Tax and fee due. If line 5 is more than line 9, subtract line 9 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

I

11 Overpayment. If line 9 is more than line 5, subtract line 5 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

I

00

12 Amount of line 11 to be credited to 2013 tax or fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

I

13 Use Tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

I

.

,

,

00

14 Refund. If the total of line 12 and line 13 is less than line 11; subtract the total from line 11 . . . .

14

I

00

15 Penalties and interest. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

.

,

00

,

16 Total amount due. Add line 10, line 12, line 13, and line 15, then subtract line 11 from the result . . .16

.Federal TIN/SSN

Single Member LLC Information and Consent — Complete only if the LLC is disregarded.

FEIN/CA Corp no./CA SOS File no.

Sole Owner’s name (as shown on owner’s return)

Return filed with the FTB by the Owner

Street Address, City, State, and ZIP Code

(1) Form 540 (5) Form 541

Member’s Consent Statement: I consent to the jurisdiction of the State of California to tax my LLC income and agree to file returns and pay tax as may be

(2) Form 100 (6) Form 100S

required by the Franchise Tax Board.

(3) Form 565 (7) Form 568

(4) Other _________________

Signature

Date

Title

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Date

Sign

Signature

Here

Telephone

of officer

.

(

)

Officer’s email address (optional)

Date

PTIN

Paid

Check if

preparer’s

self-employed

Paid

signature

Preparer’s

FEIN

-

Use Only

Firm’s name (or yours,

. .

if self-employed)

Telephone

and address

.

(

)

May the FTB discuss this return with the preparer shown above (see instructions)?. . . . . . . . . . . .

.No

Yes

Form 568

2012 Side 1

C1

3671123

For Privacy Notice, get form FTB 1131.

1

1 2

2 3

3 4

4 5

5 6

6