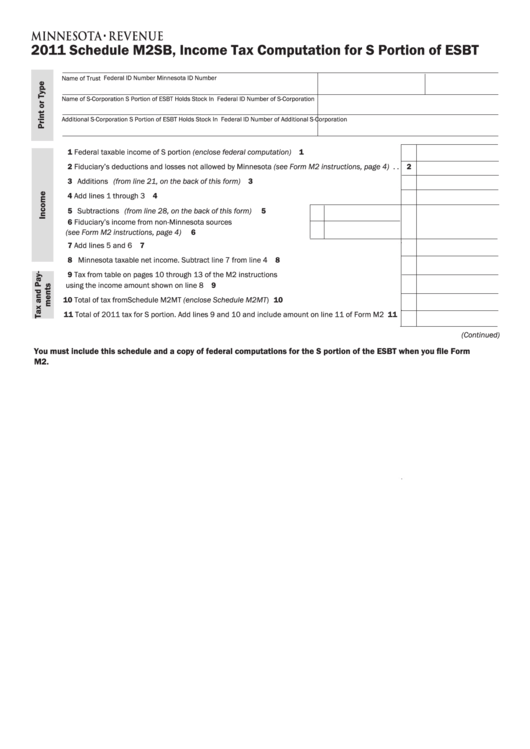

2011 Schedule M2SB, Income Tax Computation for S Portion of ESBT

Federal ID Number

Minnesota ID Number

Name of Trust

Name of S-Corporation S Portion of ESBT Holds Stock In

Federal ID Number of S-Corporation

Additional S-Corporation S Portion of ESBT Holds Stock In

Federal ID Number of Additional S-Corporation

1 Federal taxable income of S portion (enclose federal computation) . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Fiduciary’s deductions and losses not allowed by Minnesota (see Form M2 instructions, page 4) . . 2

3 Additions (from line 21, on the back of this form) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Subtractions (from line 28, on the back of this form) . . . . . . . . . . . . . . .

5

6 Fiduciary’s income from non-Minnesota sources

(see Form M2 instructions, page 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Minnesota taxable net income . Subtract line 7 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Tax from table on pages 10 through 13 of the M2 instructions

using the income amount shown on line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total of tax from Schedule M2MT (enclose Schedule M2MT) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total of 2011 tax for S portion . Add lines 9 and 10 and include amount on line 11 of Form M2 . . . . 11

(Continued)

You must include this schedule and a copy of federal computations for the S portion of the ESBT when you file Form

M2.

1

1 2

2 3

3