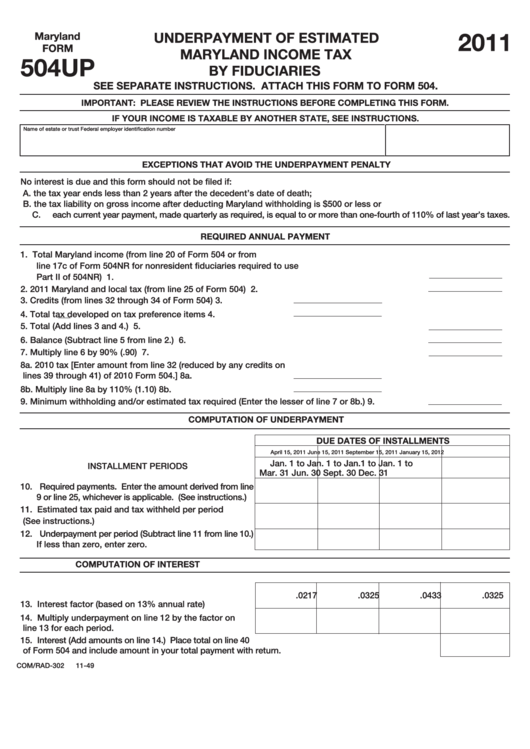

2011

UNDERPAYMENT OF ESTIMATED

Maryland

FORM

MARYLAND INCOME TAX

504UP

BY FIDUCIARIES

SEE SEPARATE INSTRUCTIONS. ATTACH THIS FORM TO FORM 504.

IMPORTANT: PLEASE REVIEW THE INSTRUCTIONS BEFORE COMPLETING THIS FORM.

IF YOUR INCOME IS TAXABLE BY ANOTHER STATE, SEE INSTRUCTIONS.

Name of estate or trust

Federal employer identification number

EXCEPTIONS THAT AVOID THE UNDERPAYMENT PENALTY

No interest is due and this form should not be filed if:

A. the tax year ends less than 2 years after the decedent’s date of death;

B. the tax liability on gross income after deducting Maryland withholding is $500 or less or

C. each current year payment, made quarterly as required, is equal to or more than one-fourth of 110% of last year’s taxes.

REQUIRED ANNUAL PAYMENT

1. Total Maryland income (from line 20 of Form 504 or from

line 17c of Form 504NR for nonresident fiduciaries required to use

Part II of 504NR)

1.

2. 2011 Maryland and local tax (from line 25 of Form 504)

2.

3. Credits (from lines 32 through 34 of Form 504)

3.

4. Total tax developed on tax preference items

4.

5. Total (Add lines 3 and 4.)

5.

6. Balance (Subtract line 5 from line 2.)

6.

7. Multiply line 6 by 90% (.90)

7.

8a. 2010 tax [Enter amount from line 32 (reduced by any credits on

lines 39 through 41) of 2010 Form 504.]

8a.

8b. Multiply line 8a by 110% (1.10)

8b.

9. Minimum withholding and/or estimated tax required (Enter the lesser of line 7 or 8b.)

9.

COMPUTATION OF UNDERPAYMENT

DUE DATES OF INSTALLMENTS

April 15, 2011

June 15, 2011

September 15, 2011

January 15, 2012

Jan. 1 to

Jan. 1 to

Jan.1 to

Jan. 1 to

INSTALLMENT PERIODS

Mar. 31

Jun. 30

Sept. 30

Dec. 31

10. Required payments. Enter the amount derived from line

9 or line 25, whichever is applicable. (See instructions.)

11. Estimated tax paid and tax withheld per period

(See instructions.)

12. Underpayment per period (Subtract line 11 from line 10.)

If less than zero, enter zero.

COMPUTATION OF INTEREST

.0217

.0325

.0433

.0325

13. Interest factor (based on 13% annual rate)

14. Multiply underpayment on line 12 by the factor on

line 13 for each period.

15. Interest (Add amounts on line 14.) Place total on line 40

of Form 504 and include amount in your total payment with return.

COM/RAD-302

11-49

1

1 2

2 3

3