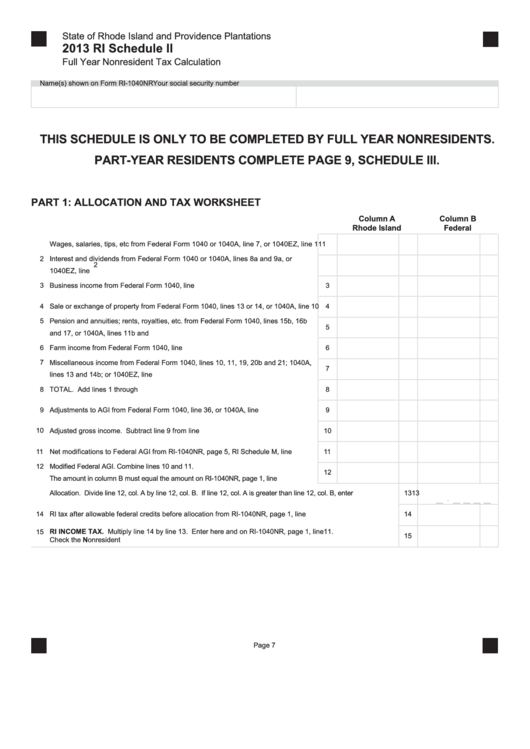

State of Rhode Island and Providence Plantations

2013 RI Schedule II

Full Year Nonresident Tax Calculation

Name(s) shown on Form RI-1040NR

Your social security number

THIS SCHEDULE IS ONLY TO BE COMPLETED BY FULL YEAR NONRESIDENTS.

PART-YEAR RESIDENTS COMPLETE PAGE 9, SCHEDULE III.

PART 1: ALLOCATION AND TAX WORKSHEET

Column A

Column B

Rhode Island

Federal

Wages, salaries, tips, etc from Federal Form 1040 or 1040A, line 7, or 1040EZ, line 1

1

1

2

Interest and dividends from Federal Form 1040 or 1040A, lines 8a and 9a, or

2

1040EZ, line 2.................................................................................................................

3

Business income from Federal Form 1040, line 12 ...........................................................

3

4

Sale or exchange of property from Federal Form 1040, lines 13 or 14, or 1040A, line 10

4

5

Pension and annuities; rents, royalties, etc. from Federal Form 1040, lines 15b, 16b

5

and 17, or 1040A, lines 11b and 12b .................................................................................

Farm income from Federal Form 1040, line 18 .................................................................

6

6

7

Miscellaneous income from Federal Form 1040, lines 10, 11, 19, 20b and 21; 1040A,

7

lines 13 and 14b; or 1040EZ, line 3 ...................................................................................

TOTAL. Add lines 1 through 7...........................................................................................

8

8

9

Adjustments to AGI from Federal Form 1040, line 36, or 1040A, line 20 ..........................

9

10

Adjusted gross income. Subtract line 9 from line 8...........................................................

10

Net modifications to Federal AGI from RI-1040NR, page 5, RI Schedule M, line 3........... 11

11

12

Modified Federal AGI. Combine lines 10 and 11.

12

The amount in column B must equal the amount on RI-1040NR, page 1, line 3....................

13

Allocation. Divide line 12, col. A by line 12, col. B. If line 12, col. A is greater than line 12, col. B, enter 1.0000 .............. 13

_ . _ _ _ _

14

RI tax after allowable federal credits before allocation from RI-1040NR, page 1, line 10...........................................

14

RI INCOME TAX. Multiply line 14 by line 13. Enter here and on RI-1040NR, page 1, line11.

15

Check the Nonresident box.........................................................................................................................................

Page 7

1

1 2

2