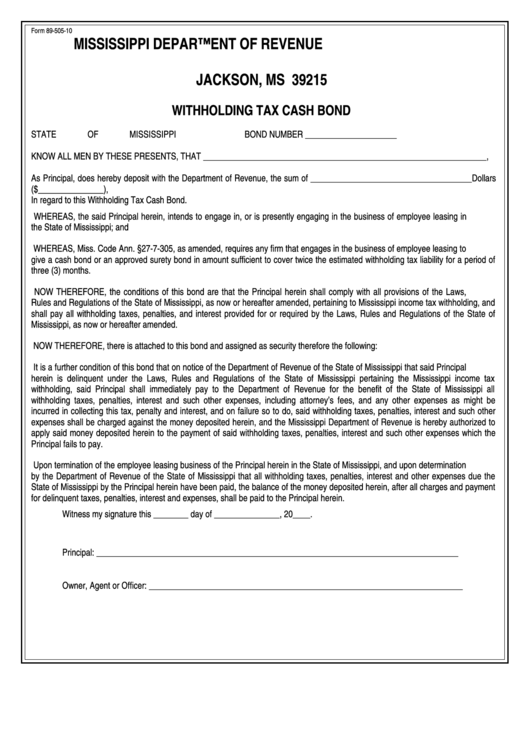

Form 89-505-10 - Withholding Tax Cash Bond

ADVERTISEMENT

Form 89-505-10

MISSISSIPPI DEPARTMENT OF REVENUE

P.O. BOX 1033

JACKSON, MS 39215

WITHHOLDING TAX CASH BOND

STATE OF MISSISSIPPI

BOND NUMBER _____________________

KNOW ALL MEN BY THESE PRESENTS, THAT _________________________________________________________________,

As Principal, does hereby deposit with the Department of Revenue, the sum of _____________________________________Dollars

($_______________),

In regard to this Withholding Tax Cash Bond.

WHEREAS, the said Principal herein, intends to engage in, or is presently engaging in the business of employee leasing in

the State of Mississippi; and

WHEREAS, Miss. Code Ann. §27-7-305, as amended, requires any firm that engages in the business of employee leasing to

give a cash bond or an approved surety bond in amount sufficient to cover twice the estimated withholding tax liability for a period of

three (3) months.

NOW THEREFORE, the conditions of this bond are that the Principal herein shall comply with all provisions of the Laws,

Rules and Regulations of the State of Mississippi, as now or hereafter amended, pertaining to Mississippi income tax withholding, and

shall pay all withholding taxes, penalties, and interest provided for or required by the Laws, Rules and Regulations of the State of

Mississippi, as now or hereafter amended.

NOW THEREFORE, there is attached to this bond and assigned as security therefore the following:

It is a further condition of this bond that on notice of the Department of Revenue of the State of Mississippi that said Principal

herein is delinquent under the Laws, Rules and Regulations of the State of Mississippi pertaining the Mississippi income tax

withholding, said Principal shall immediately pay to the Department of Revenue for the benefit of the State of Mississippi all

withholding taxes, penalties, interest and such other expenses, including attorney’s fees, and any other expenses as might be

incurred in collecting this tax, penalty and interest, and on failure so to do, said withholding taxes, penalties, interest and such other

expenses shall be charged against the money deposited herein, and the Mississippi Department of Revenue is hereby authorized to

apply said money deposited herein to the payment of said withholding taxes, penalties, interest and such other expenses which the

Principal fails to pay.

Upon termination of the employee leasing business of the Principal herein in the State of Mississippi, and upon determination

by the Department of Revenue of the State of Mississippi that all withholding taxes, penalties, interest and other expenses due the

State of Mississippi by the Principal herein have been paid, the balance of the money deposited herein, after all charges and payment

for delinquent taxes, penalties, interest and expenses, shall be paid to the Principal herein.

Witness my signature this ________ day of _______________, 20____.

Principal: ___________________________________________________________________________________

Owner, Agent or Officer: ________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1