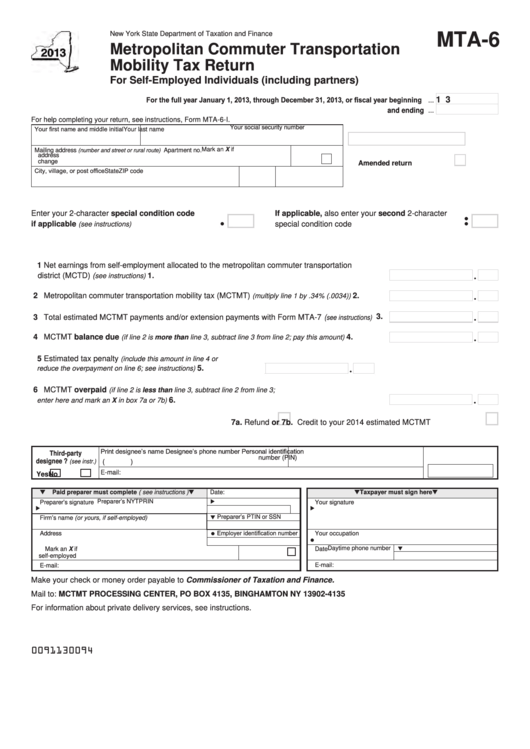

New York State Department of Taxation and Finance

MTA-6

Metropolitan Commuter Transportation

Mobility Tax Return

For Self-Employed Individuals (including partners)

For the full year January 1, 2013, through December 31, 2013, or fiscal year beginning ...

1 3

and ending ...

For help completing your return, see instructions, Form MTA-6-I.

Your social security number

Your first name and middle initial

Your last name

Mark an X if

Mailing address

Apartment no.

(number and street or rural route)

address

change

Amended return ...................

City, village, or post office

State

ZIP code

Enter your 2-character special condition code

If applicable, also enter your second 2-character

if applicable

......................................

special condition code .................................................

(see instructions)

1 Net earnings from self-employment allocated to the metropolitan commuter transportation

district (MCTD) (

............................................................................................... 1.

see instructions)

2 Metropolitan commuter transportation mobility tax (MCTMT)

....... 2.

(multiply line 1 by .34% (.0034))

3 Total estimated MCTMT payments and/or extension payments with Form MTA-7 (

3.

see instructions)

4 MCTMT balance due

.......... 4.

(if line 2 is more than line 3, subtract line 3 from line 2; pay this amount)

5 Estimated tax penalty

(include this amount in line 4 or

............... 5.

reduce the overpayment on line 6; see instructions)

6 MCTMT overpaid

(if line 2 is less than line 3, subtract line 2 from line 3;

...................................................................................... 6.

enter here and mark an X in box 7a or 7b)

7a. Refund

or

7b. Credit to your 2014 estimated MCTMT

Print designee’s name

Designee’s phone number

Personal identification

Third-party

number (PIN)

designee ?

(see instr.)

(

)

E-mail:

Yes

No

Paid preparer must complete ( see instructions )

Date:

Taxpayer must sign here

Preparer’s NYTPRIN

Preparer’s signature

Your signature

Preparer’s PTIN or SSN

Firm’s name (or yours, if self-employed)

Employer identification number

Address

Your occupation

Daytime phone number

Mark an X if

Date

self-employed

E-mail:

E-mail:

Make your check or money order payable to Commissioner of Taxation and Finance.

Mail to: MCTMT PROCESSING CENTER, PO BOX 4135, BINGHAMTON NY 13902-4135

For information about private delivery services, see instructions.

0091130094

1

1