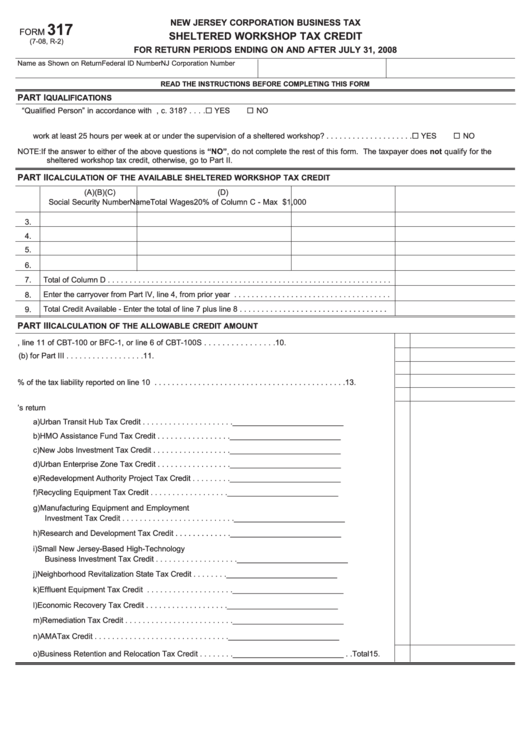

NEW JERSEY CORPORATION BUSINESS TAX

317

FORM

SHELTERED WORKSHOP TAX CREDIT

(7-08, R-2)

FOR RETURN PERIODS ENDING ON AND AFTER JULY 31, 2008

Name as Shown on Return

Federal ID Number

NJ Corporation Number

READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM

PART I

QUALIFICATIONS

1. Is each employee for which a credit is claimed a “Qualified Person” in accordance with P.L. 2005, c. 318? . . . .

YES

NO

2. Did each employee for which a credit is claimed work for at least 26 weeks during the privilege period and

work at least 25 hours per week at or under the supervision of a sheltered workshop? . . . . . . . . . . . . . . . . . . . .

YES

NO

NOTE: If the answer to either of the above questions is “NO”, do not complete the rest of this form. The taxpayer does not qualify for the

sheltered workshop tax credit, otherwise, go to Part II.

PART II

CALCULATION OF THE AVAILABLE SHELTERED WORKSHOP TAX CREDIT

(A)

(B)

(C)

(D)

Social Security Number

Name

Total Wages

20% of Column C - Max $1,000

3.

4.

5.

6.

Total of Column D . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8.

Enter the carryover from Part IV, line 4, from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Credit Available - Enter the total of line 7 plus line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

PART III

CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

10. Enter tax liability from page 1, line 11 of CBT-100 or BFC-1, or line 6 of CBT-100S . . . . . . . . . . . . . . . . 10.

11. Enter the required minimum tax liability as indicated in instruction (b) for Part III . . . . . . . . . . . . . . . . . . 11.

12. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Enter 50% of the tax liability reported on line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Enter the lesser of line 12 or line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Tax Credits taken on current year’s return

a) Urban Transit Hub Tax Credit . . . . . . . . . . . . . . . . . . . . .

__________________________

b) HMO Assistance Fund Tax Credit . . . . . . . . . . . . . . . . .

__________________________

c) New Jobs Investment Tax Credit . . . . . . . . . . . . . . . . . .

__________________________

d) Urban Enterprise Zone Tax Credit . . . . . . . . . . . . . . . . .

__________________________

e) Redevelopment Authority Project Tax Credit . . . . . . . . .

__________________________

f) Recycling Equipment Tax Credit . . . . . . . . . . . . . . . . . .

__________________________

g) Manufacturing Equipment and Employment

Investment Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . .

__________________________

h) Research and Development Tax Credit . . . . . . . . . . . . .

__________________________

i) Small New Jersey-Based High-Technology

Business Investment Tax Credit . . . . . . . . . . . . . . . . . . .

__________________________

j) Neighborhood Revitalization State Tax Credit . . . . . . . .

__________________________

k) Effluent Equipment Tax Credit . . . . . . . . . . . . . . . . . . . .

__________________________

l) Economic Recovery Tax Credit . . . . . . . . . . . . . . . . . . .

__________________________

m) Remediation Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . .

__________________________

n) AMA Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

__________________________

o) Business Retention and Relocation Tax Credit . . . . . . . .

__________________________ . .Total 15.

1

1 2

2 3

3