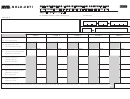

Form Nyc-2.4 - Draft - Net Operating Loss Deduction (Nold) - 2017

ADVERTISEMENT

- 2.4

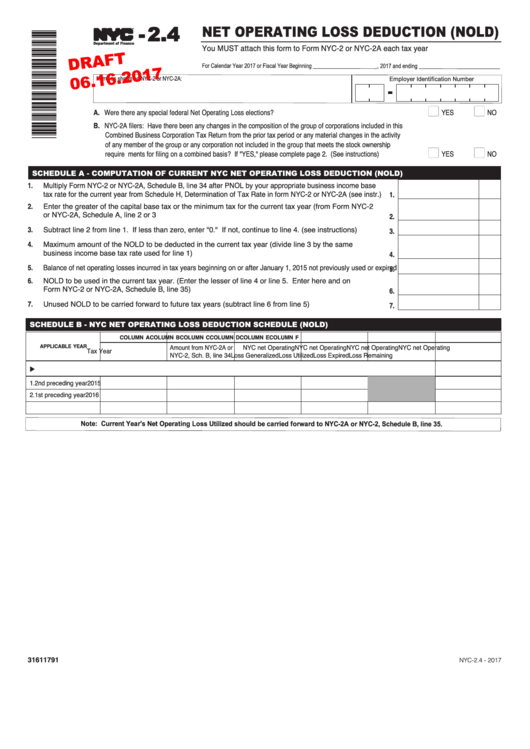

NET OPERATING LOSS DEDUCTION (NOLD)

TM

You MUST attach this form to Form NYC-2 or NYC-2A each tax year

Department of Finance

n

n

A. Were there any special federal Net Operating Loss elections?.....................................................................................

YES

NO

B. NYC-2A filers: Have there been any changes in the composition of the group of corporations included in this

Combined Business Corporation Tax Return from the prior tax period or any material changes in the activity

of any member of the group or any corporation not included in the group that meets the stock ownership

n

n

requirements for filing on a combined basis? If "YES," please complete page 2. (See instructions).........................

YES

NO

SCHEDULE A - COMPUTATION OF CURRENT NYC NET OPERATING LOSS DEDUCTION (NOLD)

1.

Multiply Form NYC-2 or NYC-2A, Schedule B, line 34 after PNOL by your appropriate business income base

tax rate for the current year from Schedule H, Determination of Tax Rate in form NYC-2 or NYC-2A (see instr.) ..... 1.

2.

Enter the greater of the capital base tax or the minimum tax for the current tax year (from Form NYC-2

or NYC-2A, Schedule A, line 2 or 3 .............................................................................................................. 2.

3.

Subtract line 2 from line 1. If less than zero, enter "0." If not, continue to line 4. (see instructions) ......... 3.

4.

Maximum amount of the NOLD to be deducted in the current tax year (divide line 3 by the same

business income base tax rate used for line 1) ............................................................................................ 4.

5.

Balance of net operating losses incurred in tax years beginning on or after January 1, 2015 not previously used or expired . 5.

6.

NOLD to be used in the current tax year. (Enter the lesser of line 4 or line 5. Enter here and on

Form NYC-2 or NYC-2A, Schedule B, line 35) ............................................................................................. 6.

7.

Unused NOLD to be carried forward to future tax years (subtract line 6 from line 5) .................................. 7.

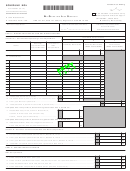

SCHEDULE B - NYC NET OPERATING LOSS DEDUCTION SCHEDULE (NOLD)

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

Amount from NYC-2A or

NYC net Operating

NYC net Operating

NYC net Operating

NYC net Operating

APPLICABLE YEAR

Tax Year

NYC-2, Sch. B, line 34

Loss Generalized

Loss Utilized

Loss Expired

Loss Remaining

A. NOL Carryforward from prior years ........................................................................................................................................................................

1. 2nd preceding year

2015

2. 1st preceding year

2016

3. Current year

2017

31611791

NYC-2.4 - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2