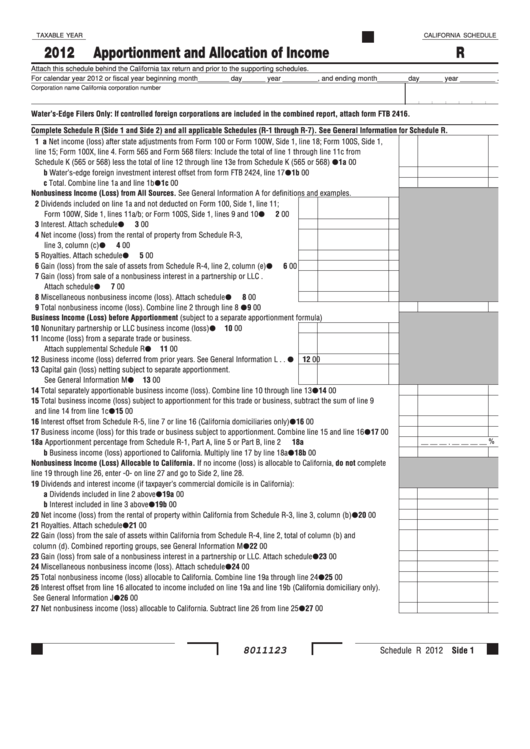

TAXABLE YEAR

CALIFORNIA SCHEDULE

2012

Apportionment and Allocation of Income

R

Attach this schedule behind the California tax return and prior to the supporting schedules.

For calendar year 2012 or fiscal year beginning month________ day______ year _________, and ending month________day______ year _________ .

Corporation name

California corporation number

Water’s-Edge Filers Only: If controlled foreign corporations are included in the combined report, attach form FTB 2416.

Complete Schedule R (Side 1 and Side 2) and all applicable Schedules (R-1 through R-7). See General Information for Schedule R.

1 a Net income (loss) after state adjustments from Form 100 or Form 100W, Side 1, line 18; Form 100S, Side 1,

line 15; Form 100X, line 4. Form 565 and Form 568 filers: Include the total of line 1 through line 11c from

Schedule K (565 or 568) less the total of line 12 through line 13e from Schedule K (565 or 568) . . . . . . . . . . .

1a

00

b Water’s-edge foreign investment interest offset from form FTB 2424, line 17. . . . . . . . . . . . . . . . . . . . . . . . . . .

1b

00

c Total. Combine line 1a and line 1b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c

00

Nonbusiness Income (Loss) from All Sources. See General Information A for definitions and examples.

2 Dividends included on line 1a and not deducted on Form 100, Side 1, line 11;

Form 100W, Side 1, lines 11a/b; or Form 100S, Side 1, lines 9 and 10 . . . . . . . .

2

00

3 Interest. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Net income (loss) from the rental of property from Schedule R-3,

line 3, column (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 Royalties. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Gain (loss) from the sale of assets from Schedule R-4, line 2, column (e). . . . . .

6

00

7 Gain (loss) from sale of a nonbusiness interest in a partnership or LLC .

Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Miscellaneous nonbusiness income (loss). Attach schedule . . . . . . . . . . . . . . . .

8

00

9 Total nonbusiness income (loss). Combine line 2 through line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

Business Income (Loss) before Apportionment (subject to a separate apportionment formula)

10 Nonunitary partnership or LLC business income (loss) . . . . . . . . . . . . . . . . . . . .

10

00

11 Income (loss) from a separate trade or business.

Attach supplemental Schedule R . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Business income (loss) deferred from prior years. See General Information L . .

12

00

13 Capital gain (loss) netting subject to separate apportionment.

See General Information M. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

14 Total separately apportionable business income (loss). Combine line 10 through line 13 . . . . . . . . . . . . . . . . . . .

14

00

15 Total business income (loss) subject to apportionment for this trade or business, subtract the sum of line 9

and line 14 from line 1c. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

00

16 Interest offset from Schedule R-5, line 7 or line 16 (California domiciliaries only). . . . . . . . . . . . . . . . . . . . . . . . .

16

00

17 Business income (loss) for this trade or business subject to apportionment. Combine line 15 and line 16 . . . . . .

17

00

__ __ __ . __ __ __ __ %

18 a Apportionment percentage from Schedule R-1, Part A, line 5 or Part B, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . .

18a

b Business income (loss) apportioned to California. Multiply line 17 by line 18a. . . . . . . . . . . . . . . . . . . . . . . . . .

18b

00

Nonbusiness Income (Loss) Allocable to California. If no income (loss) is allocable to California, do not complete

line 19 through line 26, enter -0- on line 27 and go to Side 2, line 28.

19 Dividends and interest income (if taxpayer’s commercial domicile is in California):

a Dividends included in line 2 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19a

00

b Interest included in line 3 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19b

00

20 Net income (loss) from the rental of property within California from Schedule R-3, line 3, column (b) . . . . . . . . .

20

00

21 Royalties. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22 Gain (loss) from the sale of assets within California from Schedule R-4, line 2, total of column (b) and

column (d). Combined reporting groups, see General Information M . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23 Gain (loss) from sale of a nonbusiness interest in a partnership or LLC. Attach schedule . . . . . . . . . . . . . . . . . . .

23

00

24 Miscellaneous nonbusiness income (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

00

25 Total nonbusiness income (loss) allocable to California. Combine line 19a through line 24. . . . . . . . . . . . . . . . . .

25

00

26 Interest offset from line 16 allocated to income included on line 19a and line 19b (California domiciliary only).

See General Information J . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

27 Net nonbusiness income (loss) allocable to California. Subtract line 26 from line 25 . . . . . . . . . . . . . . . . . . . . . .

27

00

Schedule R 2012 Side 1

8011123

1

1 2

2 3

3 4

4 5

5 6

6 7

7