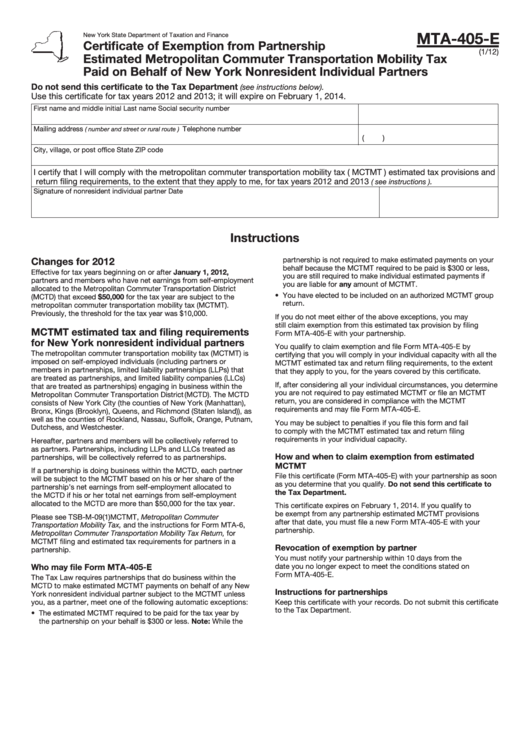

MTA-405-E

New York State Department of Taxation and Finance

Certificate of Exemption from Partnership

(1/12)

Estimated Metropolitan Commuter Transportation Mobility Tax

Paid on Behalf of New York Nonresident Individual Partners

Do not send this certificate to the Tax Department

(see instructions below).

Use this certificate for tax years 2012 and 2013; it will expire on February 1, 2014.

First name and middle initial

Last name

Social security number

Mailing address

Telephone number

( number and street or rural route )

(

)

City, village, or post office

State

ZIP code

I certify that I will comply with the metropolitan commuter transportation mobility tax ( MCTMT ) estimated tax provisions and

return filing requirements, to the extent that they apply to me, for tax years 2012 and 2013

.

( see instructions )

Signature of nonresident individual partner

Date

Instructions

Changes for 2012

partnership is not required to make estimated payments on your

behalf because the MCTMT required to be paid is $300 or less,

Effective for tax years beginning on or after January 1, 2012,

you are still required to make individual estimated payments if

partners and members who have net earnings from self-employment

you are liable for any amount of MCTMT.

allocated to the Metropolitan Commuter Transportation District

• You have elected to be included on an authorized MCTMT group

(MCTD) that exceed $50,000 for the tax year are subject to the

return.

metropolitan commuter transportation mobility tax (MCTMT).

Previously, the threshold for the tax year was $10,000.

If you do not meet either of the above exceptions, you may

still claim exemption from this estimated tax provision by filing

MCTMT estimated tax and filing requirements

Form MTA-405-E with your partnership.

for New York nonresident individual partners

You qualify to claim exemption and file Form MTA-405-E by

The metropolitan commuter transportation mobility tax (MCTMT) is

certifying that you will comply in your individual capacity with all the

imposed on self-employed individuals (including partners or

MCTMT estimated tax and return filing requirements, to the extent

members in partnerships, limited liability partnerships (LLPs) that

that they apply to you, for the years covered by this certificate.

are treated as partnerships, and limited liability companies (LLCs)

If, after considering all your individual circumstances, you determine

that are treated as partnerships) engaging in business within the

you are not required to pay estimated MCTMT or file an MCTMT

Metropolitan Commuter Transportation District (MCTD). The MCTD

return, you are considered in compliance with the MCTMT

consists of New York City (the counties of New York (Manhattan),

requirements and may file Form MTA-405-E.

Bronx, Kings (Brooklyn), Queens, and Richmond (Staten Island)), as

well as the counties of Rockland, Nassau, Suffolk, Orange, Putnam,

You may be subject to penalties if you file this form and fail

Dutchess, and Westchester.

to comply with the MCTMT estimated tax and return filing

requirements in your individual capacity.

Hereafter, partners and members will be collectively referred to

as partners. Partnerships, including LLPs and LLCs treated as

How and when to claim exemption from estimated

partnerships, will be collectively referred to as partnerships.

MCTMT

If a partnership is doing business within the MCTD, each partner

File this certificate (Form MTA-405-E) with your partnership as soon

will be subject to the MCTMT based on his or her share of the

as you determine that you qualify. Do not send this certificate to

partnership’s net earnings from self-employment allocated to

the Tax Department.

the MCTD if his or her total net earnings from self-employment

allocated to the MCTD are more than $50,000 for the tax year.

This certificate expires on February 1, 2014. If you qualify to

be exempt from any partnership estimated MCTMT provisions

Please see TSB-M-09(1)MCTMT, Metropolitan Commuter

after that date, you must file a new Form MTA-405-E with your

Transportation Mobility Tax, and the instructions for Form MTA-6,

partnership.

Metropolitan Commuter Transportation Mobility Tax Return, for

MCTMT filing and estimated tax requirements for partners in a

Revocation of exemption by partner

partnership.

You must notify your partnership within 10 days from the

date you no longer expect to meet the conditions stated on

Who may file Form MTA-405-E

Form MTA-405-E.

The Tax Law requires partnerships that do business within the

MCTD to make estimated MCTMT payments on behalf of any New

Instructions for partnerships

York nonresident individual partner subject to the MCTMT unless

you, as a partner, meet one of the following automatic exceptions:

Keep this certificate with your records. Do not submit this certificate

to the Tax Department.

• The estimated MCTMT required to be paid for the tax year by

the partnership on your behalf is $300 or less. Note: While the

1

1 2

2