Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

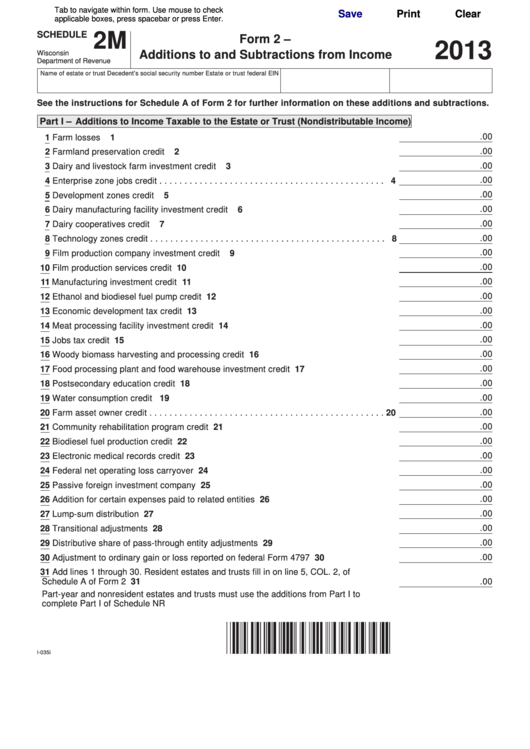

SCHEDULE

2M

Form 2 –

2013

Additions to and Subtractions from Income

Wisconsin

Department of Revenue

Name of estate or trust

Decedent’s social security number

Estate or trust federal EIN

See the instructions for Schedule A of Form 2 for further information on these additions and subtractions.

Part I – Additions to Income Taxable to the Estate or Trust (Nondistributable Income)

.00

1 Farm losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.00

2 Farmland preservation credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.00

3 Dairy and livestock farm investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.00

4 Enterprise zone jobs credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

.00

5 Development zones credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

6 Dairy manufacturing facility investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

.00

7 Dairy cooperatives credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

.00

8 Technology zones credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

.00

9 Film production company investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

.00

10 Film production services credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.00

11 Manufacturing investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.00

12 Ethanol and biodiesel fuel pump credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

.00

13 Economic development tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

.00

14 Meat processing facility investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

.00

15 Jobs tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

.00

16 Woody biomass harvesting and processing credit . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

.00

17 Food processing plant and food warehouse investment credit . . . . . . . . . . . . . . . . . . 17

.00

18 Postsecondary education credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

.00

19 Water consumption credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

.00

20 Farm asset owner credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

.00

21 Community rehabilitation program credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

.00

22 Biodiesel fuel production credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

.00

23 Electronic medical records credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

.00

24 Federal net operating loss carryover . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

.00

25 Passive foreign investment company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

.00

26 Addition for certain expenses paid to related entities . . . . . . . . . . . . . . . . . . . . . . . . . 26

.00

27 Lump-sum distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

.00

28 Transitional adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

.00

29 Distributive share of pass-through entity adjustments . . . . . . . . . . . . . . . . . . . . . . . . 29

.00

30 Adjustment to ordinary gain or loss reported on federal Form 4797 . . . . . . . . . . . . . . 30

31 Add lines 1 through 30 . Resident estates and trusts fill in on line 5, COL . 2, of

Schedule A of Form 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

.00

Part-year and nonresident estates and trusts must use the additions from Part I to

complete Part I of Schedule NR

I-035i

1

1 2

2