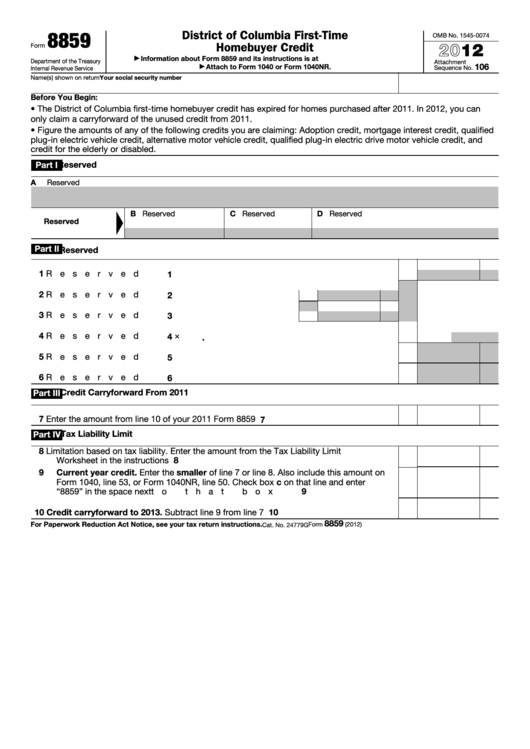

8859

District of Columbia First-Time

OMB No. 1545-0074

2012

Homebuyer Credit

Form

Information about Form 8859 and its instructions is at

▶

Department of the Treasury

Attachment

106

Attach to Form 1040 or Form 1040NR.

Internal Revenue Service

▶

Sequence No.

Your social security number

Name(s) shown on return

Before You Begin:

• The District of Columbia first-time homebuyer credit has expired for homes purchased after 2011. In 2012, you can

only claim a carryforward of the unused credit from 2011.

• Figure the amounts of any of the following credits you are claiming: Adoption credit, mortgage interest credit, qualified

plug-in electric vehicle credit, alternative motor vehicle credit, qualified plug-in electric drive motor vehicle credit, and

credit for the elderly or disabled.

Part I

Reserved

A

Reserved

B Reserved

C Reserved

D Reserved

Reserved

Part II

Reserved

1

Reserved

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Reserved

. . . . . . . . . . . . . . . . . .

2

3

Reserved

. . . . . . . . . . . . . . . . . .

3

4

Reserved

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

×

4

.

5

Reserved

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6

Reserved

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Credit Carryforward From 2011

Part III

7

Enter the amount from line 10 of your 2011 Form 8859 . . . . . . . . . . . .

7

Tax Liability Limit

Part IV

8

Limitation based on tax liability. Enter the amount from the Tax Liability Limit

8

Worksheet in the instructions . . . . . . . . . . . . . . . . . . . . .

9

Current year credit. Enter the smaller of line 7 or line 8. Also include this amount on

Form 1040, line 53, or Form 1040NR, line 50. Check box c on that line and enter

“8859” in the space next to that box

. . . . . . . . . . . . . . . . . .

9

10

Credit carryforward to 2013. Subtract line 9 from line 7 . . . . . . . . . . .

10

8859

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2012)

Cat. No. 24779G

1

1 2

2