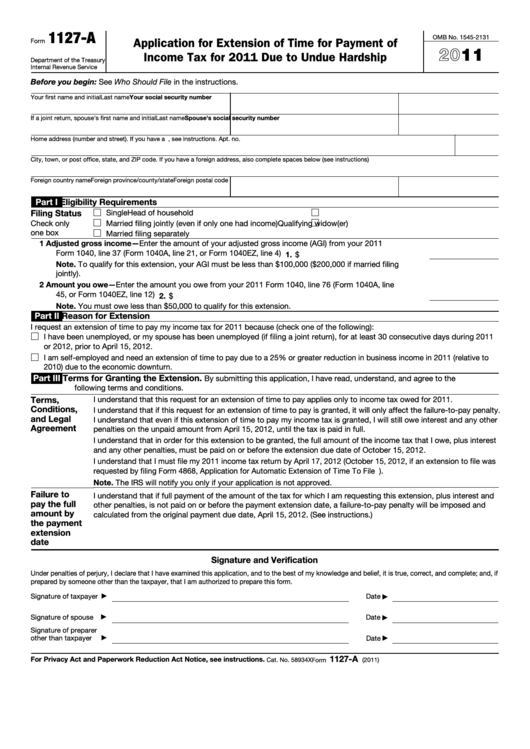

1127-A

OMB No. 1545-2131

Application for Extension of Time for Payment of

Form

2011

Income Tax for 2011 Due to Undue Hardship

Department of the Treasury

Internal Revenue Service

Before you begin: See Who Should File in the instructions.

Your first name and initial

Last name

Your social security number

If a joint return, spouse's first name and initial

Last name

Spouse's social security number

Home address (number and street). If you have a P.O. box, see instructions.

Apt. no.

City, town, or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions)

Foreign country name

Foreign province/county/state

Foreign postal code

Part I

Eligibility Requirements

Filing Status

Single

Head of household

Check only

Married filing jointly (even if only one had income)

Qualifying widow(er)

one box

Married filing separately

1

Adjusted gross income—Enter the amount of your adjusted gross income (AGI) from your 2011

Form 1040, line 37 (Form 1040A, line 21, or Form 1040EZ, line 4)

.

.

.

.

.

.

.

.

.

.

.

1. $

Note. To qualify for this extension, your AGI must be less than $100,000 ($200,000 if married filing

jointly).

2

Amount you owe—Enter the amount you owe from your 2011 Form 1040, line 76 (Form 1040A, line

45, or Form 1040EZ, line 12)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2. $

Note. You must owe less than $50,000 to qualify for this extension.

Part II

Reason for Extension

I request an extension of time to pay my income tax for 2011 because (check one of the following):

I have been unemployed, or my spouse has been unemployed (if filing a joint return), for at least 30 consecutive days during 2011

or 2012, prior to April 15, 2012.

I am self-employed and need an extension of time to pay due to a 25% or greater reduction in business income in 2011 (relative to

2010) due to the economic downturn.

Part III

Terms for Granting the Extension.

By submitting this application, I have read, understand, and agree to the

following terms and conditions.

Terms,

I understand that this request for an extension of time to pay applies only to income tax owed for 2011.

Conditions,

I understand that if this request for an extension of time to pay is granted, it will only affect the failure-to-pay penalty.

and Legal

I understand that even if this extension of time to pay my income tax is granted, I will still owe interest and any other

Agreement

penalties on the unpaid amount from April 15, 2012, until the tax is paid in full.

I understand that in order for this extension to be granted, the full amount of the income tax that I owe, plus interest

and any other penalties, must be paid on or before the extension due date of October 15, 2012.

I understand that I must file my 2011 income tax return by April 17, 2012 (October 15, 2012, if an extension to file was

requested by filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return).

Note. The IRS will notify you only if your application is not approved.

Failure to

I understand that if full payment of the amount of the tax for which I am requesting this extension, plus interest and

pay the full

other penalties, is not paid on or before the payment extension date, a failure-to-pay penalty will be imposed and

amount by

calculated from the original payment due date, April 15, 2012. (See instructions.)

the payment

extension

date

Signature and Verification

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and complete; and, if

prepared by someone other than the taxpayer, that I am authorized to prepare this form.

Signature of taxpayer

Date

▶

▶

Signature of spouse

Date

▶

▶

Signature of preparer

other than taxpayer

Date

▶

▶

1127-A

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 58934X

Form

(2011)

1

1 2

2 3

3 4

4