Form Rev 41 0091 - Aerospace Credit For Aerospace Product Development Spending By Non-Manufacturers

ADVERTISEMENT

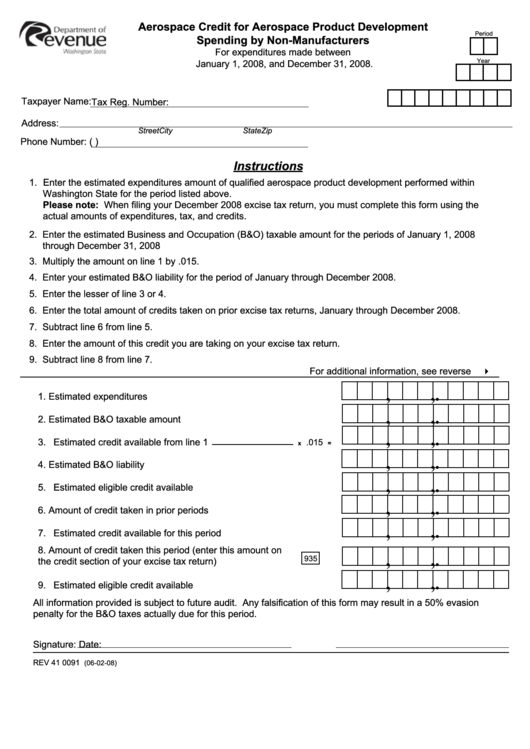

Aerospace Credit for Aerospace Product Development

Period

Spending by Non-Manufacturers

For expenditures made between

Year

January 1, 2008, and December 31, 2008.

Taxpayer Name:

Tax Reg. Number:

Address:

Street

City

State

Zip

Phone Number: (

)

Instructions

1. Enter the estimated expenditures amount of qualified aerospace product development performed within

Washington State for the period listed above.

Please note: When filing your December 2008 excise tax return, you must complete this form using the

actual amounts of expenditures, tax, and credits.

2. Enter the estimated Business and Occupation (B&O) taxable amount for the periods of January 1, 2008

through December 31, 2008

3. Multiply the amount on line 1 by .015.

4. Enter your estimated B&O liability for the period of January through December 2008.

5. Enter the lesser of line 3 or 4.

6. Enter the total amount of credits taken on prior excise tax returns, January through December 2008.

7. Subtract line 6 from line 5.

8. Enter the amount of this credit you are taking on your excise tax return.

9. Subtract line 8 from line 7.

For additional information, see reverse 4

,

,

.

1. Estimated expenditures ....................................................................

,

,

.

2. Estimated B&O taxable amount .......................................................

,

,

.

3. Estimated credit available from line 1

.015

x

=

,

,

.

4. Estimated B&O liability ....................................................................

,

,

.

5. Estimated eligible credit available ...................................................

,

,

.

6. Amount of credit taken in prior periods ............................................

,

,

.

7. Estimated credit available for this period .........................................

8. Amount of credit taken this period (enter this amount on

,

,

.

935

the credit section of your excise tax return) ......................................

,

,

.

9. Estimated eligible credit available ...................................................

All information provided is subject to future audit. Any falsification of this form may result in a 50% evasion

penalty for the B&O taxes actually due for this period.

Signature:

Date:

REV 41 0091

(06-02-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2