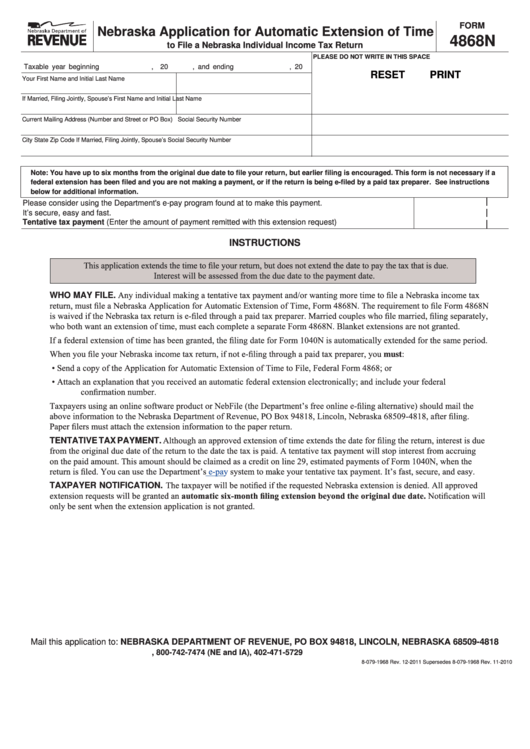

FORM

Nebraska Application for Automatic Extension of Time

4868N

to File a Nebraska Individual Income Tax Return

PLEASE DO NOT WRITE IN THIS SPACE

Taxable year beginning

, 20

, and ending

, 20

RESET

PRINT

Your First Name and Initial

Last Name

If Married, Filing Jointly, Spouse’s First Name and Initial Last Name

Current Mailing Address (Number and Street or PO Box)

Social Security Number

City

State

Zip Code

If Married, Filing Jointly, Spouse’s Social Security Number

Note: You have up to six months from the original due date to file your return, but earlier filing is encouraged. This form is not necessary if a

federal extension has been filed and you are not making a payment, or if the return is being e-filed by a paid tax preparer. See instructions

below for additional information.

Please consider using the Department's e-pay program found at to make this payment.

It’s secure, easy and fast.

Tentative tax payment (Enter the amount of payment remitted with this extension request) ...................................

INSTRUCTIONS

This application extends the time to file your return, but does not extend the date to pay the tax that is due.

Interest will be assessed from the due date to the payment date.

WHO MAY FILE. Any individual making a tentative tax payment and/or wanting more time to file a Nebraska income tax

return, must file a Nebraska Application for Automatic Extension of Time, Form 4868N. The requirement to file Form 4868N

is waived if the Nebraska tax return is e-filed through a paid tax preparer. Married couples who file married, filing separately,

who both want an extension of time, must each complete a separate Form 4868N. Blanket extensions are not granted.

If a federal extension of time has been granted, the filing date for Form 1040N is automatically extended for the same period.

When you file your Nebraska income tax return, if not e-filing through a paid tax preparer, you must:

•

Send a copy of the Application for Automatic Extension of Time to File, Federal Form 4868; or

•

Attach an explanation that you received an automatic federal extension electronically; and include your federal

confirmation number.

Taxpayers using an online software product or NebFile (the Department’s free online e-filing alternative) should mail the

above information to the Nebraska Department of Revenue, PO Box 94818, Lincoln, Nebraska 68509-4818, after filing.

Paper filers must attach the extension information to the paper return.

TENTATIVE TAX PAYMENT. Although an approved extension of time extends the date for filing the return, interest is due

from the original due date of the return to the date the tax is paid. A tentative tax payment will stop interest from accruing

on the paid amount. This amount should be claimed as a credit on line 29, estimated payments of Form 1040N, when the

return is filed. You can use the Department’s

e-pay

system to make your tentative tax payment. It’s fast, secure, and easy.

TAXPAYER NOTIFICATION. The taxpayer will be notified if the requested Nebraska extension is denied. All approved

extension requests will be granted an automatic six-month filing extension beyond the original due date. Notification will

only be sent when the extension application is not granted.

Mail this application to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94818, LINCOLN, NEBRASKA 68509-4818

, 800-742-7474 (NE and IA), 402-471-5729

8-079-1968 Rev. 12-2011 Supersedes 8-079-1968 Rev. 11-2010

1

1