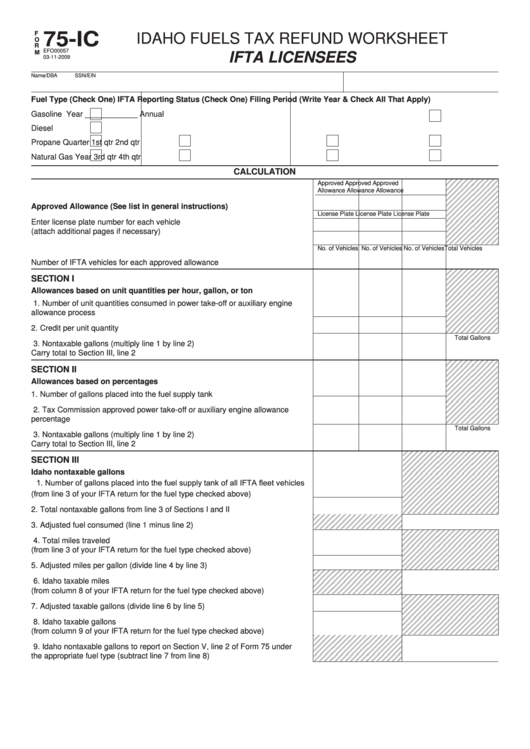

Form 75-Ic - Idaho Fuels Tax Refund Worksheet - Ifta Licensees

ADVERTISEMENT

F

75-IC

idaho fuels tax refund WorKsheet

O

R

efo00057

M

IFTA LICENSEES

03-11-2009

name/dBa

ssn/ein

Fuel Type (Check One)

IFTA Reporting Status (Check One)

Filing Period (Write Year & Check All That Apply)

Gasoline

Year ____________

annual

diesel

Propane

Quarter

1st qtr

2nd qtr

natural Gas

Year

3rd qtr

4th qtr

CAlCulATIOn

approved

approved

approved

allowance

allowance

allowance

Approved Allowance (See list in general instructions) .....................................

license Plate

license Plate

license Plate

enter license plate number for each vehicle

(attach additional pages if necessary) .....................................................................

no. of Vehicles no. of Vehicles no. of Vehicles

total Vehicles

number of ifta vehicles for each approved allowance ..........................................

SeCTIOn I

Allowances based on unit quantities per hour, gallon, or ton

1.

number of unit quantities consumed in power take-off or auxiliary engine

allowance process .......................................................................................

2.

Credit per unit quantity allowed....................................................................

total Gallons

3.

nontaxable gallons (multiply line 1 by line 2)

Carry total to section iii, line 2 .....................................................................

SeCTIOn II

Allowances based on percentages

1.

number of gallons placed into the fuel supply tank .....................................

2.

tax Commission approved power take-off or auxiliary engine allowance

percentage ...................................................................................................

total Gallons

3.

nontaxable gallons (multiply line 1 by line 2)

Carry total to section iii, line 2 .....................................................................

SeCTIOn III

Idaho nontaxable gallons

1.

Number of gallons placed into the fuel supply tank of all IFTA fleet vehicles

(from line 3 of your ifta return for the fuel type checked above) ................

2.

total nontaxable gallons from line 3 of sections i and ii ..............................

3.

adjusted fuel consumed (line 1 minus line 2) ..............................................

4.

total miles traveled

(from line 3 of your ifta return for the fuel type checked above) ................

5.

adjusted miles per gallon (divide line 4 by line 3) ........................................

6.

idaho taxable miles

(from column 8 of your ifta return for the fuel type checked above) ..........

7.

adjusted taxable gallons (divide line 6 by line 5) .........................................

8.

idaho taxable gallons

(from column 9 of your ifta return for the fuel type checked above) ..........

9.

idaho nontaxable gallons to report on section V, line 2 of form 75 under

the appropriate fuel type (subtract line 7 from line 8)...................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3