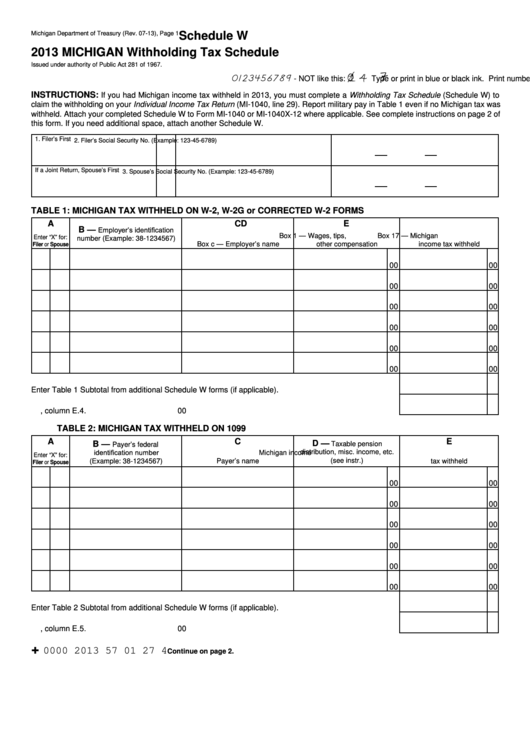

Michigan Department of Treasury (Rev. 07-13), Page 1

Schedule W

2013 MICHIGAN Withholding Tax Schedule

Issued under authority of Public Act 281 of 1967.

1 4

0123456789

Type or print in blue or black ink. Print numbers like this:

- NOT like this:

Attachment 13

INSTRUCTIONS:

If you had Michigan income tax withheld in 2013, you must complete a Withholding Tax Schedule (Schedule W) to

claim the withholding on your Individual Income Tax Return (MI-1040, line 29). Report military pay in Table 1 even if no Michigan tax was

withheld. Attach your completed Schedule W to Form MI-1040 or MI-1040X-12 where applicable. See complete instructions on page 2 of

this form. If you need additional space, attach another Schedule W.

1. Filer’s First Name

M.I.

Last Name

2. Filer’s Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

3. Spouse’s Social Security No. (Example: 123-45-6789)

TABLE 1: MICHIGAN TAX WITHHELD ON W-2, W-2G or CORRECTED W-2 FORMS

A

C

D

E

Employer’s identification

B —

Box 1 — Wages, tips,

Box 17 — Michigan

Enter “X” for:

number (Example: 38-1234567)

Box c — Employer’s name

other compensation

income tax withheld

Filer or Spouse

00

00

00

00

00

00

00

00

00

00

00

00

Enter Table 1 Subtotal from additional Schedule W forms (if applicable). ......................................................

00

4. SUBTOTAL. Enter total of Table 1, column E. ................................................................................ 4.

00

TABLE 2: MICHIGAN TAX WITHHELD ON 1099

A

C

E

D —

B —

Taxable pension

Payer’s federal

identification number

distribution, misc. income, etc.

Michigan income

Enter “X” for:

(see instr.)

(Example: 38-1234567)

Payer’s name

tax withheld

Filer or Spouse

00

00

00

00

00

00

00

00

00

00

00

00

Enter Table 2 Subtotal from additional Schedule W forms (if applicable). ......................................................

00

5. SUBTOTAL. Enter total of Table 2, column E. ..............................................................................

5.

00

+

0000 2013 57 01 27 4

Continue on page 2.

1

1 2

2