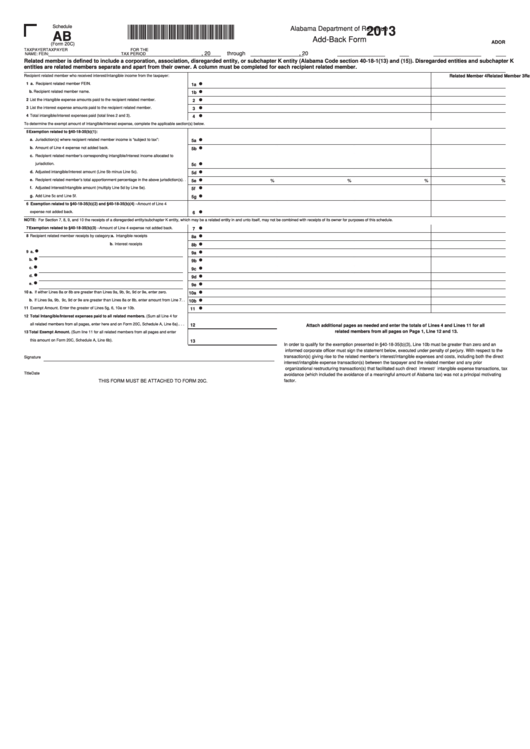

2013

1300052C1283

Schedule

Alabama Department of Revenue

AB

Add-Back Form

ADOR

(Form 20C)

TAXPAYER

TAXPAYER

FOR THE

, 20

through

, 20

NAME:

FEIN:

TAX PERIOD

Related member is defined to include a corporation, association, disregarded entity, or subchapter K entity (Alabama Code section 40-18-1(13) and (15)). Disregarded entities and subchapter K

entities are related members separate and apart from their owner. A column must be completed for each recipient related member.

Recipient related member who received interest/intangible income from the taxpayer:

Related Member 1

Related Member 2

Related Member 3

Related Member 4

1 a. Recipient related member FEIN. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a

b. Recipient related member name. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b

2 List the intangible expense amounts paid to the recipient related member. . . . . . . . . . . . . . . .

2

3 List the interest expense amounts paid to the recipient related member. . . . . . . . . . . . . . . . . .

3

4 Total intangible/interest expenses paid (total lines 2 and 3).. . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

To determine the exempt amount of intangible/interest expense, complete the applicable section(s) below.

5 Exemption related to §40-18-35(b)(1):

a. Jurisdiction(s) where recipient related member income is “subject to tax”: . . . . . . . . . . . . .

5a

b. Amount of Line 4 expense not added back. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5b

c. Recipient related member’s corresponding intangible/interest income allocated to

jurisdiction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5c

d. Adjusted intangible/interest amount (Line 5b minus Line 5c). . . . . . . . . . . . . . . . . . . . . . . . .

5d

e. Recipient related member’s total apportionment percentage in the above jurisdiction(s). .

5e

%

%

%

%

f. Adjusted interest/intangible amount (multiply Line 5d by Line 5e).. . . . . . . . . . . . . . . . . . . .

5f

g. Add Line 5c and Line 5f. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5g

6 Exemption related to §40-18-35(b)(2) and §40-18-35(b)(4) – Amount of Line 4

expense not added back. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

NOTE: For Section 7, 8, 9, and 10 the receipts of a disregarded entity/subchapter K entity, which may be a related entity in and unto itself, may not be combined with receipts of its owner for purposes of this schedule.

7 Exemption related to §40-18-35(b)(3) – Amount of Line 4 expense not added back. . . . . . .

7

8 Recipient related member receipts by category: a. Intangible receipts . . . . . . . . . . . . . . . . . .

8a

b. lnterest receipts . . . . . . . . . . . . . . . . . . . .

8b

9 a.

9a

b.

9b

c.

9c

d.

9d

e.

9e

10 a. If either Lines 8a or 8b are greater than Lines 9a, 9b, 9c, 9d or 9e, enter zero. . . . . . . . . .

10a

b. If Lines 9a, 9b, 9c, 9d or 9e are greater than Lines 8a or 8b, enter amount from Line 7. .

10b

11 Exempt Amount. Enter the greater of Lines 5g, 6, 10a or 10b.. . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Total Intangible/Interest expenses paid to all related members. (Sum all Line 4 for

all related members from all pages, enter here and on Form 20C, Schedule A, Line 6a). . . .

12

Attach additional pages as needed and enter the totals of Lines 4 and Lines 11 for all

related members from all pages on Page 1, Line 12 and 13.

13 Total Exempt Amount. (Sum line 11 for all related members from all pages and enter

this amount on Form 20C, Schedule A, Line 6b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

In order to qualify for the exemption presented in §40-18-35(b)(3), Line 10b must be greater than zero and an

informed corporate officer must sign the statement below, executed under penalty of perjury. With respect to the

transaction(s) giving rise to the related member’s interest/intangible expenses and costs, including both the direct

Signature

interest/intangible expense transaction(s) between the taxpayer and the related member and any prior

organizational restructuring transaction(s) that facilitated such direct interest/ intangible expense transactions, tax

Title

Date

avoidance (which included the avoidance of a meaningful amount of Alabama tax) was not a principal motivating

factor.

THIS FORM MUST BE ATTACHED TO FORM 20C.

1

1 2

2