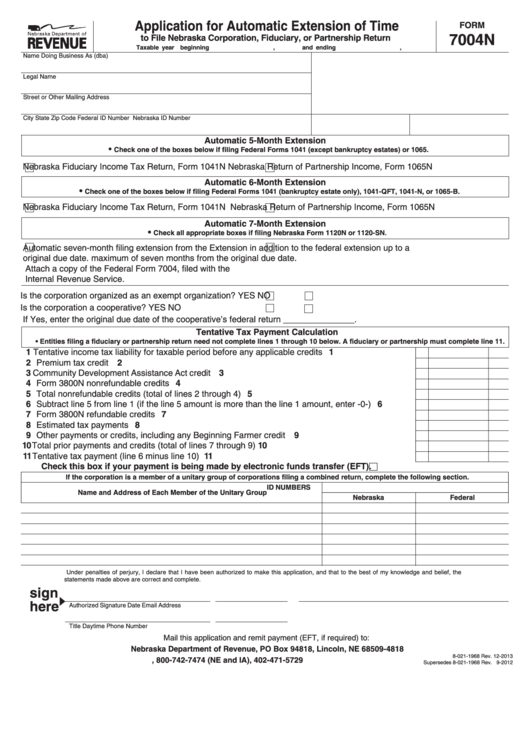

Application for Automatic Extension of Time

FORM

7004N

to File Nebraska Corporation, Fiduciary, or Partnership Return

Taxable year beginning

,

and ending

,

Name Doing Business As (dba)

Legal Name

Street or Other Mailing Address

City

State

Zip Code

Federal ID Number

Nebraska ID Number

Automatic 5-Month Extension

•

Check one of the boxes below if filing Federal Forms 1041 (except bankruptcy estates) or 1065.

Nebraska Fiduciary Income Tax Return, Form 1041N

Nebraska Return of Partnership Income, Form 1065N

Automatic 6-Month Extension

•

Check one of the boxes below if filing Federal Forms 1041 (bankruptcy estate only), 1041-QFT, 1041-N, or 1065-B.

Nebraska Fiduciary Income Tax Return, Form 1041N

Nebraska Return of Partnership Income, Form 1065N

Automatic 7-Month Extension

•

Check all appropriate boxes if filing Nebraska Form 1120N or 1120-SN.

Automatic seven-month filing extension from the

Extension in addition to the federal extension up to a

original due date.

maximum of seven months from the original due date.

Attach a copy of the Federal Form 7004, filed with the

Internal Revenue Service.

Is the corporation organized as an exempt organization?

YES

NO

Is the corporation a cooperative?

YES

NO

If Yes, enter the original due date of the cooperative’s federal return _______________.

Tentative Tax Payment Calculation

• Entities filing a fiduciary or partnership return need not complete lines 1 through 10 below. A fiduciary or partnership must complete line 11.

1 Tentative income tax liability for taxable period before any applicable credits . . . . . . . . . . . . . . . . . . . 1

2 Premium tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Community Development Assistance Act credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Form 3800N nonrefundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Total nonrefundable credits (total of lines 2 through 4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Subtract line 5 from line 1 (if the line 5 amount is more than the line 1 amount, enter -0-) . . . . . . . . . 6

7 Form 3800N refundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Other payments or credits, including any Beginning Farmer credit . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total prior payments and credits (total of lines 7 through 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Tentative tax payment (line 6 minus line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Check this box if your payment is being made by electronic funds transfer (EFT).

If the corporation is a member of a unitary group of corporations filing a combined return, complete the following section.

ID NUMBERS

Name and Address of Each Member of the Unitary Group

Nebraska

Federal

Under penalties of perjury, I declare that I have been authorized to make this application, and that to the best of my knowledge and belief, the

statements made above are correct and complete.

sign

here

Authorized Signature

Date

Email Address

Title

Daytime Phone Number

Mail this application and remit payment (EFT, if required) to:

Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818

8-021-1968 Rev. 12-2013

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

Supersedes 8-021-1968 Rev. 9-2012

1

1 2

2