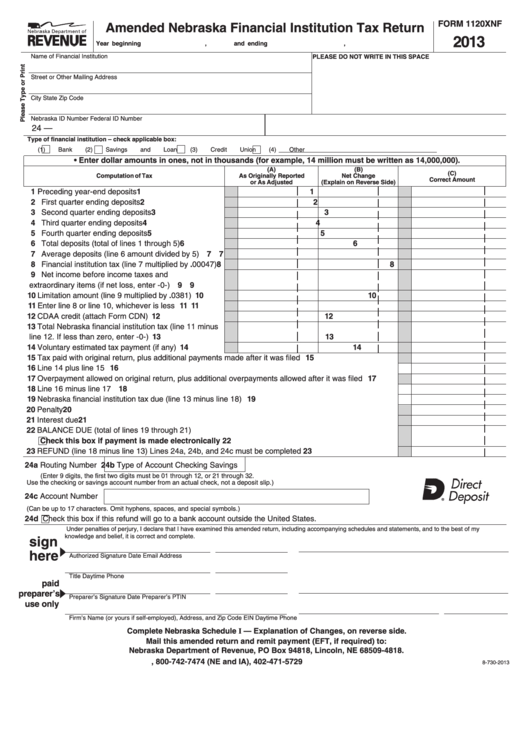

FORM 1120XNF

Amended Nebraska Financial Institution Tax Return

2013

Year beginning

,

and ending

,

Name of Financial Institution

PLEASE DO NOT WRITE IN THIS SPACE

Street or Other Mailing Address

City

State

Zip Code

Nebraska ID Number

Federal ID Number

24 —

Type of financial institution – check applicable box:

(1)

Bank

(2)

Savings and Loan

(3)

Credit Union

(4)

Other

• Enter dollar amounts in ones, not in thousands (for example, 14 million must be written as 14,000,000).

(A)

(B)

(C)

Computation of Tax

As Originally Reported

Net Change

Correct Amount

or As Adjusted

(Explain on Reverse Side)

1 Preceding year-end deposits ........................................

1

1

2 First quarter ending deposits ........................................

2

2

3 Second quarter ending deposits ...................................

3

3

4 Third quarter ending deposits .......................................

4

4

5 Fourth quarter ending deposits ....................................

5

5

6 Total deposits (total of lines 1 through 5) ......................

6

6

7 Average deposits (line 6 amount divided by 5) .............

7

7

8 Financial institution tax (line 7 multiplied by .00047) ....

8

8

9 Net income before income taxes and

extraordinary items (if net loss, enter -0-) .....................

9

9

10 Limitation amount (line 9 multiplied by .0381) .............. 10

10

11 Enter line 8 or line 10, whichever is less ....................... 11

11

12 CDAA credit (attach Form CDN) ................................... 12

12

13 Total Nebraska financial institution tax (line 11 minus

line 12. If less than zero, enter -0-) ............................... 13

13

14 Voluntary estimated tax payment (if any) ...................... 14

14

15 Tax paid with original return, plus additional payments made after it was filed ............................................ 15

16 Line 14 plus line 15 ...................................................................................................................................... 16

17 Overpayment allowed on original return, plus additional overpayments allowed after it was filed ............... 17

18 Line 16 minus line 17 .................................................................................................................................. 18

19 Nebraska financial institution tax due (line 13 minus line 18) ...................................................................... 19

20 Penalty ......................................................................................................................................................... 20

21 Interest due .................................................................................................................................................. 21

22 BALANCE DUE (total of lines 19 through 21)

Check this box if payment is made electronically ............................................................................ 22

23 REFUND (line 18 minus line 13) Lines 24a, 24b, and 24c must be completed .......................................... 23

24a Routing Number

24b Type of Account

Checking

Savings

(Enter 9 digits, the first two digits must be 01 through 12, or 21 through 32.

Use the checking or savings account number from an actual check, not a deposit slip.)

24c Account Number

(Can be up to 17 characters. Omit hyphens, spaces, and special symbols.)

24d

Check this box if this refund will go to a bank account outside the United States.

Under penalties of perjury, I declare that I have examined this amended return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is correct and complete.

sign

here

Authorized Signature

Date

Email Address

Title

Daytime Phone

paid

preparer’s

Preparer’s Signature

Date

Preparer’s PTIN

use only

Firm’s Name (or yours if self-employed), Address, and Zip Code

EIN

Daytime Phone

Complete Nebraska Schedule I — Explanation of Changes, on reverse side.

Mail this amended return and remit payment (EFT, if required) to:

Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

8-730-2013

1

1 2

2 3

3