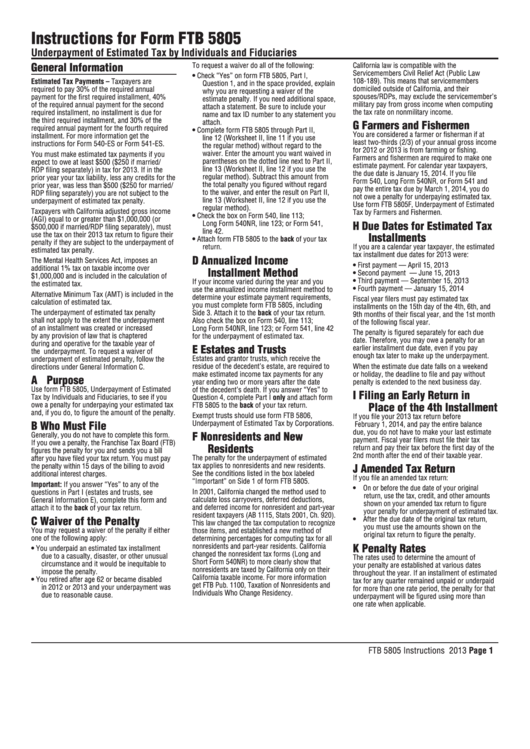

Instructions For Form Ftb 5805 - Underpayment Of Estimated Tax By Individuals And Fiduciaries - 2013

ADVERTISEMENT

Instructions for Form FTB 5805

Underpayment of Estimated Tax by Individuals and Fiduciaries

General Information

To request a waiver do all of the following:

California law is compatible with the

Servicemembers Civil Relief Act (Public Law

• Check “Yes” on form FTB 5805, Part I,

108‑189). This means that servicemembers

Estimated Tax Payments – Taxpayers are

Question 1, and in the space provided, explain

domiciled outside of California, and their

required to pay 30% of the required annual

why you are requesting a waiver of the

spouses/RDPs, may exclude the servicemember’s

payment for the first required installment, 40%

estimate penalty. If you need additional space,

military pay from gross income when computing

of the required annual payment for the second

attach a statement. Be sure to include your

the tax rate on nonmilitary income.

required installment, no installment is due for

name and tax ID number to any statement you

the third required installment, and 30% of the

attach.

G Farmers and Fishermen

required annual payment for the fourth required

• Complete form FTB 5805 through Part II,

You are considered a farmer or fisherman if at

installment. For more information get the

line 12 (Worksheet II, line 11 if you use

least two‑thirds (2/3) of your annual gross income

instructions for Form 540‑ES or Form 541‑ES.

the regular method) without regard to the

for 2012 or 2013 is from farming or fishing.

waiver. Enter the amount you want waived in

You must make estimated tax payments if you

Farmers and fishermen are required to make one

parentheses on the dotted line next to Part II,

expect to owe at least $500 ($250 if married/

estimate payment. For calendar year taxpayers,

line 13 (Worksheet II, line 12 if you use the

RDP filing separately) in tax for 2013. If in the

the due date is January 15, 2014. If you file

regular method). Subtract this amount from

prior year your tax liability, less any credits for the

Form 540, Long Form 540NR, or Form 541 and

the total penalty you figured without regard

prior year, was less than $500 ($250 for married/

pay the entire tax due by March 1, 2014, you do

to the waiver, and enter the result on Part II,

RDP filing separately) you are not subject to the

not owe a penalty for underpaying estimated tax.

line 13 (Worksheet II, line 12 if you use the

underpayment of estimated tax penalty.

Use form FTB 5805F, Underpayment of Estimated

regular method).

Taxpayers with California adjusted gross income

Tax by Farmers and Fishermen.

• Check the box on Form 540, line 113;

(AGI) equal to or greater than $1,000,000 (or

H Due Dates for Estimated Tax

Long Form 540NR, line 123; or Form 541,

$500,000 if married/RDP filing separately), must

line 42.

use the tax on their 2013 tax return to figure their

Installments

• Attach form FTB 5805 to the back of your tax

penalty if they are subject to the underpayment of

return.

If you are a calendar year taxpayer, the estimated

estimated tax penalty.

tax installment due dates for 2013 were:

D Annualized Income

The Mental Health Services Act, imposes an

• First payment

—

April 15, 2013

additional 1% tax on taxable income over

Installment Method

• Second payment —

June 15, 2013

$1,000,000 and is included in the calculation of

• Third payment

—

September 15, 2013

If your income varied during the year and you

the estimated tax.

• Fourth payment —

January 15, 2014

use the annualized income installment method to

Alternative Minimum Tax (AMT) is included in the

determine your estimate payment requirements,

Fiscal year filers must pay estimated tax

calculation of estimated tax.

you must complete form FTB 5805, including

installments on the 15th day of the 4th, 6th, and

The underpayment of estimated tax penalty

Side 3. Attach it to the back of your tax return.

9th months of their fiscal year, and the 1st month

shall not apply to the extent the underpayment

Also check the box on Form 540, line 113;

of the following fiscal year.

of an installment was created or increased

Long Form 540NR, line 123; or Form 541, line 42

The penalty is figured separately for each due

by any provision of law that is chaptered

for the underpayment of estimated tax.

date. Therefore, you may owe a penalty for an

during and operative for the taxable year of

E Estates and Trusts

earlier installment due date, even if you pay

the underpayment. To request a waiver of

enough tax later to make up the underpayment.

Estates and grantor trusts, which receive the

underpayment of estimated penalty, follow the

residue of the decedent’s estate, are required to

When the estimate due date falls on a weekend

directions under General Information C.

make estimated income tax payments for any

or holiday, the deadline to file and pay without

A Purpose

year ending two or more years after the date

penalty is extended to the next business day.

Use form FTB 5805, Underpayment of Estimated

of the decedent’s death. If you answer “Yes” to

I

Filing an Early Return in

Tax by Individuals and Fiduciaries, to see if you

Question 4, complete Part I only and attach form

owe a penalty for underpaying your estimated tax

Place of the 4th Installment

FTB 5805 to the back of your tax return.

and, if you do, to figure the amount of the penalty.

Exempt trusts should use form FTB 5806,

If you file your 2013 tax return before

B Who Must File

Underpayment of Estimated Tax by Corporations.

February 1, 2014, and pay the entire balance

due, you do not have to make your last estimate

F Nonresidents and New

Generally, you do not have to complete this form.

payment. Fiscal year filers must file their tax

If you owe a penalty, the Franchise Tax Board (FTB)

Residents

return and pay their tax before the first day of the

figures the penalty for you and sends you a bill

2nd month after the end of their taxable year.

The penalty for the underpayment of estimated

after you have filed your tax return. You must pay

tax applies to nonresidents and new residents.

J Amended Tax Return

the penalty within 15 days of the billing to avoid

See the conditions listed in the box labeled

additional interest charges.

If you file an amended tax return:

“Important” on Side 1 of form FTB 5805.

Important: If you answer “Yes” to any of the

• On or before the due date of your original

In 2001, California changed the method used to

questions in Part I (estates and trusts, see

return, use the tax, credit, and other amounts

calculate loss carryovers, deferred deductions,

General Information E), complete this form and

shown on your amended tax return to figure

and deferred income for nonresident and part‑year

attach it to the back of your tax return.

your penalty for underpayment of estimated tax.

resident taxpayers (AB 1115, Stats 2001, Ch. 920).

C Waiver of the Penalty

• After the due date of the original tax return,

This law changed the tax computation to recognize

you must use the amounts shown on the

You may request a waiver of the penalty if either

those items, and established a new method of

original tax return to figure the penalty.

one of the following apply:

determining percentages for computing tax for all

K Penalty Rates

nonresidents and part‑year residents. California

• You underpaid an estimated tax installment

changed the nonresident tax forms (Long and

due to a casualty, disaster, or other unusual

The rates used to determine the amount of

Short Form 540NR) to more clearly show that

circumstance and it would be inequitable to

your penalty are established at various dates

nonresidents are taxed by California only on their

impose the penalty.

throughout the year. If an installment of estimated

California taxable income. For more information

• You retired after age 62 or became disabled

tax for any quarter remained unpaid or underpaid

get FTB Pub. 1100, Taxation of Nonresidents and

in 2012 or 2013 and your underpayment was

for more than one rate period, the penalty for that

Individuals Who Change Residency.

due to reasonable cause.

underpayment will be figured using more than

one rate when applicable.

FTB 5805 Instructions 2013 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4