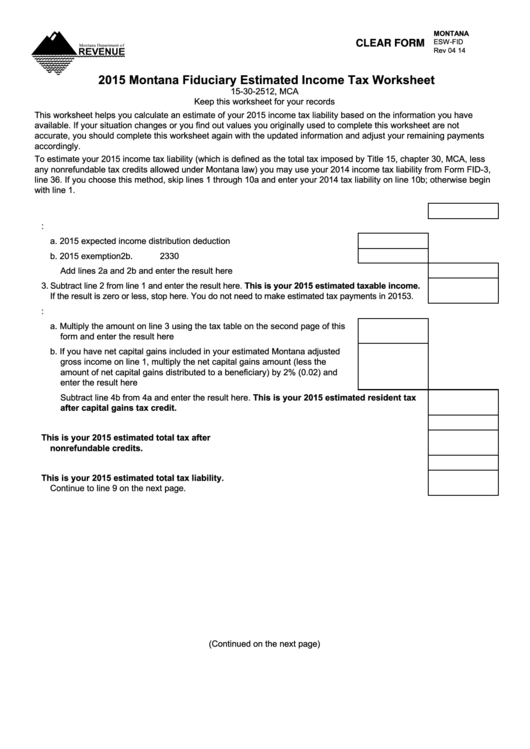

MONTANA

ESW-FID

CLEAR FORM

Rev 04 14

2015 Montana Fiduciary Estimated Income Tax Worksheet

15-30-2512, MCA

Keep this worksheet for your records

This worksheet helps you calculate an estimate of your 2015 income tax liability based on the information you have

available. If your situation changes or you find out values you originally used to complete this worksheet are not

accurate, you should complete this worksheet again with the updated information and adjust your remaining payments

accordingly.

To estimate your 2015 income tax liability (which is defined as the total tax imposed by Title 15, chapter 30, MCA, less

any nonrefundable tax credits allowed under Montana law) you may use your 2014 income tax liability from Form FID-3,

line 36. If you choose this method, skip lines 1 through 10a and enter your 2014 tax liability on line 10b; otherwise begin

with line 1.

1. Enter your 2015 estimated Montana adjusted total income here ....................................................1.

2. Enter the estimated amount of your:

a. 2015 expected income distribution deduction .............................................. 2a.

b. 2015 exemption ............................................................................................2b.

2330

Add lines 2a and 2b and enter the result here ............................................................................2.

3. Subtract line 2 from line 1 and enter the result here. This is your 2015 estimated taxable income.

If the result is zero or less, stop here. You do not need to make estimated tax payments in 2015 ....3.

4. Calculate your estimated 2015 income tax:

a. Multiply the amount on line 3 using the tax table on the second page of this

form and enter the result here ...................................................................... 4a.

b. If you have net capital gains included in your estimated Montana adjusted

gross income on line 1, multiply the net capital gains amount (less the

amount of net capital gains distributed to a beneficiary) by 2% (0.02) and

enter the result here ..................................................................................... 4b.

Subtract line 4b from 4a and enter the result here. This is your 2015 estimated resident tax

after capital gains tax credit. ....................................................................................................4.

5. Enter your 2015 estimated nonrefundable single-year credits and carryover credits here .............5.

6. Subtract line 5 from line 4 and enter the result here. This is your 2015 estimated total tax after

nonrefundable credits. ..................................................................................................................6.

7. Enter your estimated 2015 recapture taxes here ............................................................................7.

8. Add lines 6 and 7 and enter the result here. This is your 2015 estimated total tax liability.

Continue to line 9 on the next page. ................................................................................................8.

(Continued on the next page)

1

1 2

2 3

3