Most taxpayers who fi le their returns electronically and request

direct deposit will receive their refunds in 10-15 business days.

Paper returns will take approximately 30 days to process.

Reset Form

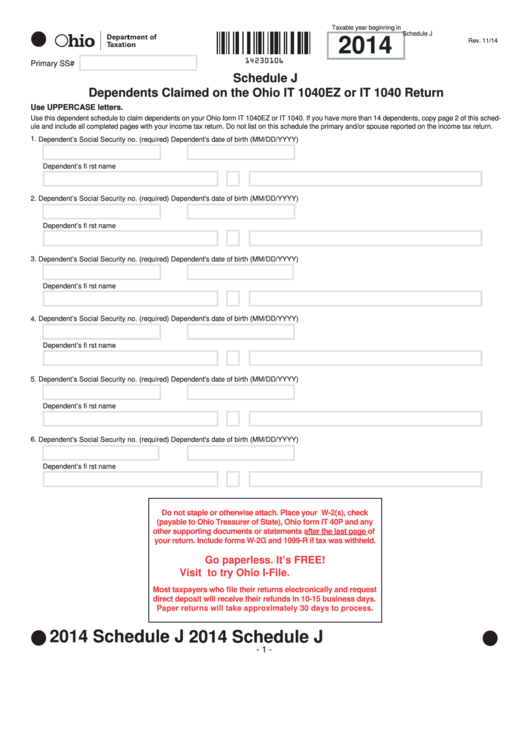

Taxable year beginning in

Schedule J

2014

Rev. 11/14

Primary SS#

Schedule J

Dependents Claimed on the Ohio IT 1040EZ or IT 1040 Return

Use UPPERCASE letters.

Use this dependent schedule to claim dependents on your Ohio form IT 1040EZ or IT 1040. If you have more than 14 dependents, copy page 2 of this sched-

ule and include all completed pages with your income tax return. Do not list on this schedule the primary and/or spouse reported on the income tax return.

1. Dependent’s Social Security no. (required)

Dependent's date of birth (MM/DD/YYYY)

Dependent’s fi rst name

M.I.

Last name

2. Dependent’s Social Security no. (required)

Dependent's date of birth (MM/DD/YYYY)

Dependent’s fi rst name

M.I.

Last name

3. Dependent’s Social Security no. (required)

Dependent's date of birth (MM/DD/YYYY)

Dependent’s fi rst name

M.I.

Last name

4. Dependent’s Social Security no. (required)

Dependent's date of birth (MM/DD/YYYY)

Dependent’s fi rst name

M.I.

Last name

5. Dependent’s Social Security no. (required)

Dependent's date of birth (MM/DD/YYYY)

Dependent’s fi rst name

M.I.

Last name

6. Dependent’s Social Security no. (required)

Dependent's date of birth (MM/DD/YYYY)

Dependent’s fi rst name

M.I.

Last name

Do not staple or otherwise attach. Place your W-2(s), check

(payable to Ohio Treasurer of State), Ohio form IT 40P and any

other supporting documents or statements after the last page of

your return. Include forms W-2G and 1099-R if tax was withheld.

Go paperless. It’s FREE!

Visit tax.ohio.gov to try Ohio I-File.

Most taxpayers who file their returns electronically and request

direct deposit will receive their refunds in 10-15 business days.

Paper returns will take approximately 30 days to process.

2014 Schedule J

2014 Schedule J

- 1 -

1

1 2

2