Reset Form

Schedule E

Rev. 1/15

10211411

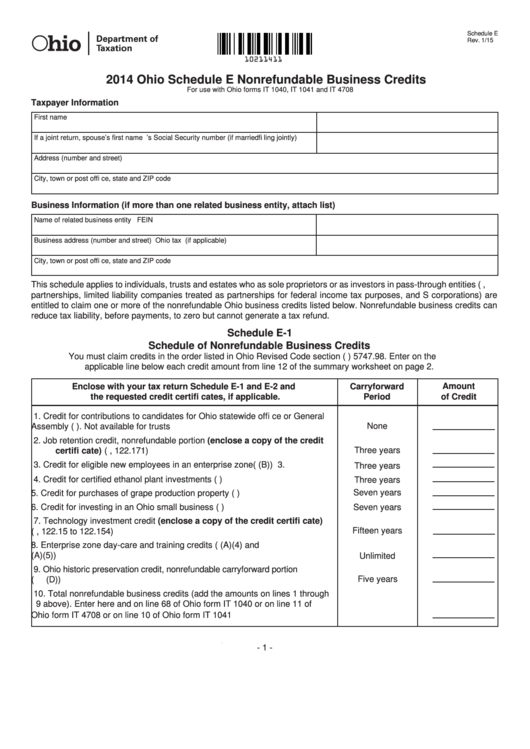

2014 Ohio Schedule E Nonrefundable Business Credits

For use with Ohio forms IT 1040, IT 1041 and IT 4708

Taxpayer Information

First name

M.I.

Last name

Social Security number

If a joint return, spouse’s fi rst name

M.I.

Last name

Spouse’s Social Security number (if married fi ling jointly)

Address (number and street)

City, town or post offi ce, state and ZIP code

Business Information (if more than one related business entity, attach list)

Name of related business entity

FEIN

Business address (number and street)

Ohio tax I.D. number (if applicable)

City, town or post offi ce, state and ZIP code

This schedule applies to individuals, trusts and estates who as sole proprietors or as investors in pass-through entities (e.g.,

partnerships, limited liability companies treated as partnerships for federal income tax purposes, and S corporations) are

entitled to claim one or more of the nonrefundable Ohio business credits listed below. Nonrefundable business credits can

reduce tax liability, before payments, to zero but cannot generate a tax refund.

Schedule E-1

Schedule of Nonrefundable Business Credits

You must claim credits in the order listed in Ohio Revised Code section (R.C.) 5747.98. Enter on the

applicable line below each credit amount from line 12 of the summary worksheet on page 2.

Amount

Enclose with your tax return Schedule E-1 and E-2 and

Carryforward

of Credit

the requested credit certifi cates, if applicable.

Period

1. Credit for contributions to candidates for Ohio statewide offi ce or General

None

Assembly (R.C. 5747.29). Not available for trusts .......................................

1.

2. Job retention credit, nonrefundable portion (enclose a copy of the credit

certifi cate) (R.C. 5747.058, 122.171)..........................................................

Three years

2.

3. Credit for eligible new employees in an enterprise zone (R.C. 5709.66(B))

Three years

3.

4. Credit for certifi ed ethanol plant investments (R.C. 5747.75).......................

Three years

4.

Seven years

5. Credit for purchases of grape production property (R.C. 5747.28) ..............

5.

6. Credit for investing in an Ohio small business (R.C. 5747.81) .....................

Seven years

6.

7. Technology investment credit (enclose a copy of the credit certifi cate)

Fifteen years

(R.C. 5747.33, 122.15 to 122.154) ...............................................................

7.

8. Enterprise zone day-care and training credits (R.C. 5709.65 (A)(4) and

(A)(5)) ...........................................................................................................

8.

Unlimited

9. Ohio historic preservation credit, nonrefundable carryforward portion

Five years

(R.C. 5747.76(D)) .........................................................................................

9.

10. Total nonrefundable business credits (add the amounts on lines 1 through

9 above). Enter here and on line 68 of Ohio form IT 1040 or on line 11 of

Ohio form IT 4708 or on line 10 of Ohio form IT 1041 ..................................

10.

- 1 -

1

1 2

2 3

3 4

4 5

5 6

6