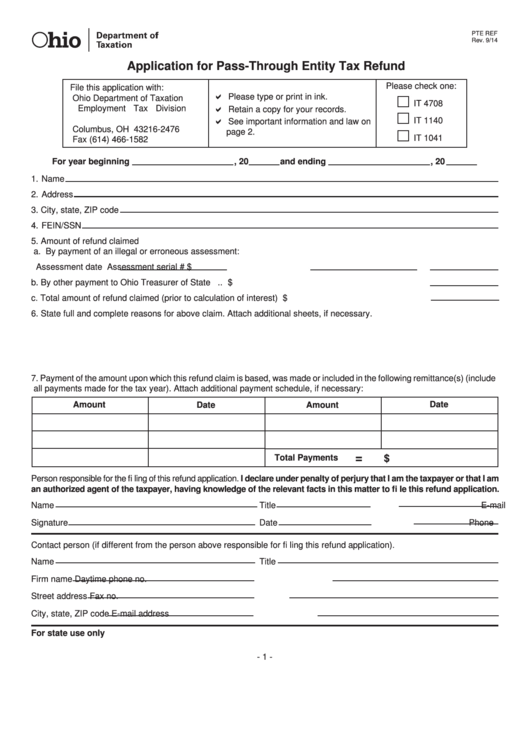

PTE REF

Rev. 9/14

Reset Form

Application for Pass-Through Entity Tax Refund

Please check one:

File this application with:

Please type or print in ink.

Ohio Department of Taxation

IT 4708

Employment Tax Division

Retain a copy for your records.

P.O. Box 2476

See important information and law on

IT 1140

Columbus, OH 43216-2476

page 2.

IT 1041

Fax (614) 466-1582

For year beginning

, 20

and ending

, 20

1. Name

2. Address

3. City, state, ZIP code

4. FEIN/SSN

5. Amount of refund claimed

a. By payment of an illegal or erroneous assessment:

Assessment date

Assessment serial #

$

b. By other payment to Ohio Treasurer of State ................................................................................ $

c. Total amount of refund claimed (prior to calculation of interest) .................................................... $

6. State full and complete reasons for above claim. Attach additional sheets, if necessary.

7. Payment of the amount upon which this refund claim is based, was made or included in the following remittance(s) (include

all payments made for the tax year). Attach additional payment schedule, if necessary:

Amount

Date

Amount

Date

=

Total Payments

$

Person responsible for the fi ling of this refund application. I declare under penalty of perjury that I am the taxpayer or that I am

an authorized agent of the taxpayer, having knowledge of the relevant facts in this matter to fi le this refund application.

Name

Title

E-mail

Signature

Date

Phone no.

Contact person (if different from the person above responsible for fi ling this refund application).

Name

Title

Firm name

Daytime phone no.

Street address

Fax no.

City, state, ZIP code

E-mail address

For state use only

- 1 -

1

1 2

2