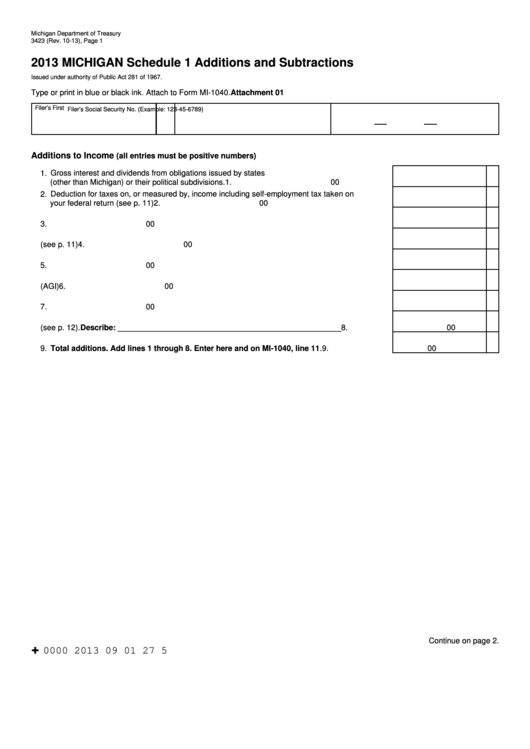

Michigan Department of Treasury

3423 (Rev. 10-13), Page 1

2013 MICHIGAN Schedule 1 Additions and Subtractions

Issued under authority of Public Act 281 of 1967.

Type or print in blue or black ink. Attach to Form MI-1040.

Attachment 01

Filer’s First Name

M.I.

Last Name

Filer’s Social Security No. (Example: 123-45-6789)

Additions to Income

(all entries must be positive numbers)

1. Gross interest and dividends from obligations issued by states

(other than Michigan) or their political subdivisions. ....................................................................

1.

00

2. Deduction for taxes on, or measured by, income including self-employment tax taken on

your federal return (see p. 11) .....................................................................................................

2.

00

3. Gains from Michigan column of MI-1040D and MI-4797 ............................................................

3.

00

4. Losses attributable to other states (see p. 11) ............................................................................

4.

00

5. Net loss from federal column of your Michigan MI-1040D or MI-4797 .......................................

5.

00

6. Oil and gas expenses deducted to arrive at Adjusted Gross Income (AGI) ...............................

6.

00

7. Federal Net Operating Loss deduction .......................................................................................

7.

00

8. Other (see p. 12). Describe: ___________________________________________________

8.

00

9. Total additions. Add lines 1 through 8. Enter here and on MI-1040, line 11. .......................

9.

00

Continue on page 2.

+

0000 2013 09 01 27 5

1

1 2

2