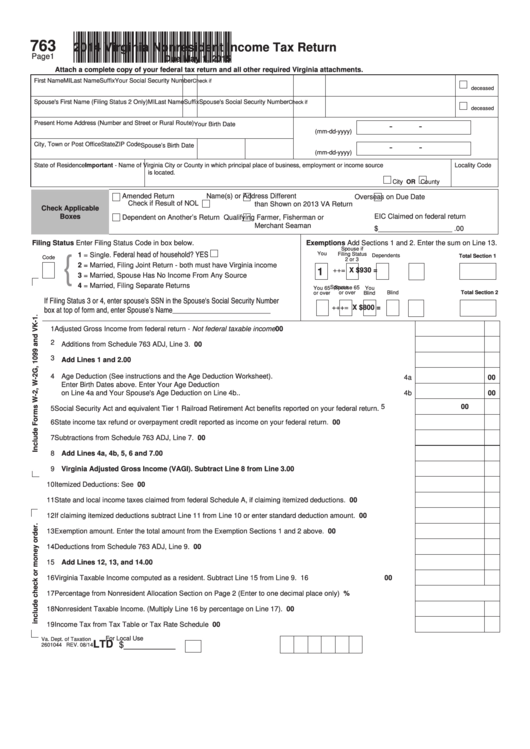

*VA0763114888*

763

2014 Virginia Nonresident Income Tax Return

Page1

Due May 1, 2015

Attach a complete copy of your federal tax return and all other required Virginia attachments.

First Name

MI

Last Name

Suffix

Your Social Security Number

Check if

deceased

Spouse's First Name (Filing Status 2 Only)

MI

Last Name

Suffix

Spouse's Social Security Number

Check if

deceased

Present Home Address (Number and Street or Rural Route)

Your Birth Date

-

-

(mm-dd-yyyy)

City, Town or Post Office

State

ZIP Code

Spouse’s Birth Date

-

-

(mm-dd-yyyy)

State of Residence

Important - Name of Virginia City or County in which principal place of business, employment or income source

Locality Code

is located.

City OR

County

Amended Return

Name(s) or Address Different

Overseas on Due Date

Check if Result of NOL

than Shown on 2013 VA Return

Check Applicable

Boxes

EIC Claimed on federal return

Dependent on Another’s Return

Qualifying Farmer, Fisherman or

Merchant Seaman

$___________________ .00

Filing Status Enter Filing Status Code in box below.

Exemptions Add Sections 1 and 2. Enter the sum on Line 13.

Spouse if

{

Federal head of household? YES

You

Filing Status

1 = Single.

Dependents

Total Section 1

Code

2 or 3

2 = Married, Filing Joint Return - both must have Virginia income

+

+

=

X $930 =

1

3 = Married, Spouse Has No Income From Any Source

4 = Married, Filing Separate Returns

Spouse 65

Spouse

You 65

You

or over

Blind

Total Section 2

or over

Blind

If Filing Status 3 or 4, enter spouse's SSN in the Spouse's Social Security Number

+

+

+

=

X $800 =

box at top of form and, enter Spouse’s Name

_______________________________

1 Adjusted Gross Income from federal return - Not federal taxable income...........................................................

1

00

2 Additions from Schedule 763 ADJ, Line 3. ..........................................................................................................

2

00

3 Add Lines 1 and 2. ............................................................................................................................................

3

00

4 Age Deduction (See instructions and the Age Deduction Worksheet). ..................................................... You

4a

00

Enter Birth Dates above. Enter Your Age Deduction

on Line 4a and Your Spouse's Age Deduction on Line 4b.. ................................................................. Spouse

4b

00

5

00

5 Social Security Act and equivalent Tier 1 Railroad Retirement Act benefits reported on your federal return. ....

6 State income tax refund or overpayment credit reported as income on your federal return. ..............................

6

00

7 Subtractions from Schedule 763 ADJ, Line 7. .....................................................................................................

7

00

8 Add Lines 4a, 4b, 5, 6 and 7..............................................................................................................................

8

00

9 Virginia Adjusted Gross Income (VAGI). Subtract Line 8 from Line 3. .........................................................

9

00

10 Itemized Deductions: See instructions.......................................... ......................................................................

10

00

11 State and local income taxes claimed from federal Schedule A, if claiming itemized deductions. ......................

11

00

12 If claiming itemized deductions subtract Line 11 from Line 10 or enter standard deduction amount. .................

12

00

13 Exemption amount. Enter the total amount from the Exemption Sections 1 and 2 above. .................................

13

00

14 Deductions from Schedule 763 ADJ, Line 9. .......................................................................................................

14

00

15 Add Lines 12, 13, and 14. ..................................................................................................................................

15

00

16 Virginia Taxable Income computed as a resident. Subtract Line 15 from Line 9. ................................................

16

00

17 Percentage from Nonresident Allocation Section on Page 2 (Enter to one decimal place only) .........................

17

%

18 Nonresident Taxable Income. (Multiply Line 16 by percentage on Line 17). .......................................................

18

00

19 Income Tax from Tax Table or Tax Rate Schedule ...............................................................................................

19

00

For Local Use

Va. Dept. of Taxation

LTD

_________

$

2601044 REV. 08/14

1

1 2

2