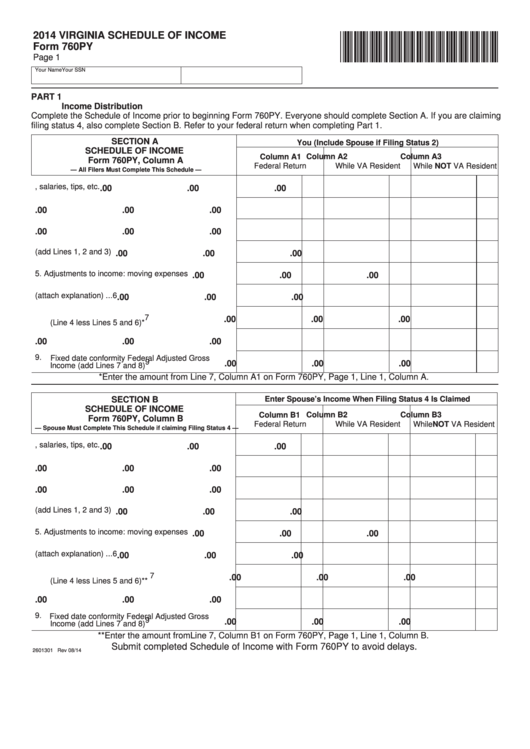

2014 VIRGINIA SCHEDULE OF INCOME

*VAPYIN114888*

Form 760PY

Page 1

Your Name

Your SSN

PART 1

Income Distribution

Complete the Schedule of Income prior to beginning Form 760PY. Everyone should complete Section A. If you are claiming

filing status 4, also complete Section B. Refer to your federal return when completing Part 1.

SECTION A

You (Include Spouse if Filing Status 2)

SCHEDULE OF INCOME

Column A1

Column A2

Column A3

Form 760PY, Column A

Federal Return

While VA Resident

While NOT VA Resident

— All Filers Must Complete This Schedule —

1.

Wages, salaries, tips, etc. .....................................

1

.00

.00

.00

2.

Interest and dividends ..........................................

2

.00

.00

.00

3.

Pension and other income ....................................

3

.00

.00

.00

4.

Gross income (add Lines 1, 2 and 3) ...................

4

.00

.00

.00

5.

Adjustments to income: moving expenses ...........

5

.00

.00

.00

6.

Other income adjustments (attach explanation) ...

6

.00

.00

.00

7.

Adjusted gross income

7

.00

.00

.00

(Line 4 less Lines 5 and 6)* ..................................

8.

Net fixed date conformity modifications ................

8

.00

.00

.00

9.

Fixed date conformity Federal Adjusted Gross

9

.00

.00

.00

Income (add Lines 7 and 8) ..................................

*Enter the amount from Line 7, Column A1 on Form 760PY, Page 1, Line 1, Column A.

SECTION B

Enter Spouse’s Income When Filing Status 4 Is Claimed

SCHEDULE OF INCOME

Column B1

Column B2

Column B3

Form 760PY, Column B

Federal Return

While VA Resident

While NOT VA Resident

— Spouse Must Complete This Schedule if claiming Filing Status 4 —

1. Wages, salaries, tips, etc. .....................................

1

.00

.00

.00

2. Interest and dividends ..........................................

2

.00

.00

.00

3. Pension and other income ....................................

3

.00

.00

.00

4. Gross income (add Lines 1, 2 and 3) ...................

4

.00

.00

.00

5. Adjustments to income: moving expenses ...........

5

.00

.00

.00

6. Other income adjustments (attach explanation) ...

6

.00

.00

.00

7. Adjusted gross income

7

.00

.00

.00

(Line 4 less Lines 5 and 6)**.................................

8. Net fixed date conformity modifications ................

8

.00

.00

.00

9. Fixed date conformity Federal Adjusted Gross

9

.00

.00

.00

Income (add Lines 7 and 8) ..................................

**Enter the amount from Line 7, Column B1 on Form 760PY, Page 1, Line 1, Column B.

Submit completed Schedule of Income with Form 760PY to avoid delays.

2601301 Rev 08/14

1

1 2

2