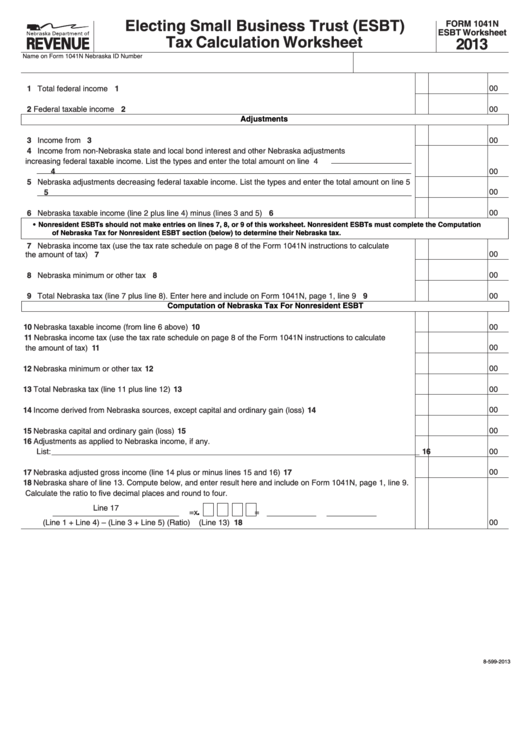

Electing Small Business Trust (ESBT)

FORM 1041N

ESBT Worksheet

Tax Calculation Worksheet

2013

Name on Form 1041N

Nebraska ID Number

1 Total federal income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 Federal taxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

Adjustments

3 Income from U .S . government bonds or other U .S . obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Income from non-Nebraska state and local bond interest and other Nebraska adjustments

increasing federal taxable income . List the types and enter the total amount on line 4

4

00

5 Nebraska adjustments decreasing federal taxable income . List the types and enter the total amount on line 5

5

00

6 Nebraska taxable income (line 2 plus line 4) minus (lines 3 and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

• Nonresident ESBTs should not make entries on lines 7, 8, or 9 of this worksheet. Nonresident ESBTs must complete the Computation

of Nebraska Tax for Nonresident ESBT section (below) to determine their Nebraska tax.

7 Nebraska income tax (use the tax rate schedule on page 8 of the Form 1041N instructions to calculate

the amount of tax) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

00

8 Nebraska minimum or other tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

00

9 Total Nebraska tax (line 7 plus line 8) . Enter here and include on Form 1041N, page 1, line 9 . . . . . . . . . . . . . . 9

00

Computation of Nebraska Tax For Nonresident ESBT

10 Nebraska taxable income (from line 6 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11 Nebraska income tax (use the tax rate schedule on page 8 of the Form 1041N instructions to calculate

the amount of tax) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

12 Nebraska minimum or other tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

00

13 Total Nebraska tax (line 11 plus line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

14 Income derived from Nebraska sources, except capital and ordinary gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . 14

00

15 Nebraska capital and ordinary gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

00

16 Adjustments as applied to Nebraska income, if any .

List: ____________________________________________________________________________________ 16

00

17 Nebraska adjusted gross income (line 14 plus or minus lines 15 and 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

00

18 Nebraska share of line 13 . Compute below, and enter result here and include on Form 1041N, page 1, line 9 .

Calculate the ratio to five decimal places and round to four .

Line 17

.

=

x

=

18

00

(Line 1 + Line 4) – (Line 3 + Line 5)

(Ratio)

(Line 13)

8-599-2013

1

1 2

2