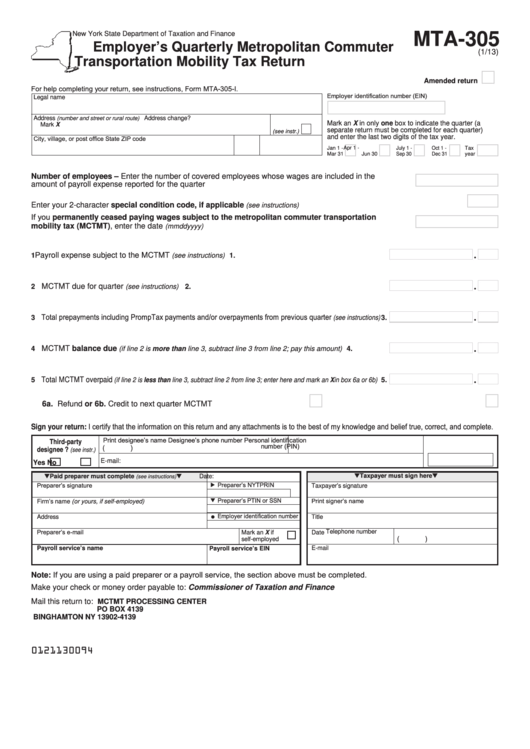

New York State Department of Taxation and Finance

MTA-305

Employer’s Quarterly Metropolitan Commuter

(1/13)

Transportation Mobility Tax Return

Amended return

For help completing your return, see instructions, Form MTA-305-I.

Employer identification number (EIN)

Legal name

Address

(number and street or rural route)

Address change?

Mark an X in only one box to indicate the quarter (a

Mark X

separate return must be completed for each quarter)

(see instr.)

and enter the last two digits of the tax year.

City, village, or post office

State

ZIP code

Jan 1 -

Apr 1 -

July 1 -

Oct 1 -

Tax

Mar 31

Jun 30

Sep 30

Dec 31

year

Number of employees – Enter the number of covered employees whose wages are included in the

amount of payroll expense reported for the quarter ...............................................................................................

Enter your 2-character special condition code, if applicable

...........................................................................

(see instructions)

If you permanently ceased paying wages subject to the metropolitan commuter transportation

mobility tax (MCTMT), enter the date

................................................................................................

(mmddyyyy)

Payroll expense subject to the MCTMT

..................................................................

1

(see instructions)

1.

MCTMT due for quarter

..........................................................................................

2

(see instructions)

2.

Total prepayments including PrompTax payments and/or overpayments from previous quarter

3

(see instructions) 3.

MCTMT balance due

...............

4

(if line 2 is more than line 3, subtract line 3 from line 2; pay this amount)

4.

Total MCTMT overpaid

5

(if line 2 is less than line 3, subtract line 2 from line 3; enter here and mark an X in box 6a or 6b) 5.

6a. Refund

or

6b. Credit to next quarter MCTMT

Sign your return: I certify that the information on this return and any attachments is to the best of my knowledge and belief true, correct, and complete.

Print designee’s name

Designee’s phone number

Personal identification

Third-party

number (PIN)

(

)

designee ?

(see instr.)

E-mail:

Yes

No

Taxpayer must sign here

Paid preparer must complete

Date:

(see instructions)

Preparer’s NYTPRIN

Preparer’s signature

Taxpayer’s signature

Preparer’s PTIN or SSN

Print signer’s name

Firm’s name (or yours, if self-employed)

Employer identification number

Address

Title

Preparer’s e-mail

Telephone number

Mark an X if

Date

(

)

self-employed

Payroll service’s name

Payroll service’s EIN

E-mail

Note: If you are using a paid preparer or a payroll service, the section above must be completed.

Make your check or money order payable to: Commissioner of Taxation and Finance

Mail this return to:

MCTMT PROCESSING CENTER

PO BOX 4139

BINGHAMTON NY 13902-4139

0121130094

1

1