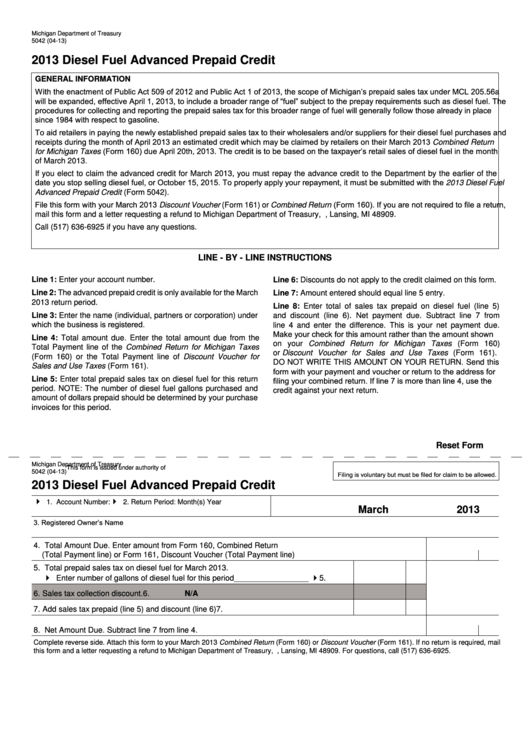

Michigan Department of Treasury

5042 (04-13)

2013 Diesel Fuel Advanced Prepaid Credit

GENERAL INFORMATION

With the enactment of Public Act 509 of 2012 and Public Act 1 of 2013, the scope of Michigan’s prepaid sales tax under MCL 205.56a

will be expanded, effective April 1, 2013, to include a broader range of “fuel” subject to the prepay requirements such as diesel fuel. The

procedures for collecting and reporting the prepaid sales tax for this broader range of fuel will generally follow those already in place

since 1984 with respect to gasoline.

To aid retailers in paying the newly established prepaid sales tax to their wholesalers and/or suppliers for their diesel fuel purchases and

receipts during the month of April 2013 an estimated credit which may be claimed by retailers on their March 2013 Combined Return

for Michigan Taxes (Form 160) due April 20th, 2013. The credit is to be based on the taxpayer’s retail sales of diesel fuel in the month

of March 2013.

If you elect to claim the advanced credit for March 2013, you must repay the advance credit to the Department by the earlier of the

date you stop selling diesel fuel, or October 15, 2015. To properly apply your repayment, it must be submitted with the 2013 Diesel Fuel

Advanced Prepaid Credit (Form 5042).

File this form with your March 2013 Discount Voucher (Form 161) or Combined Return (Form 160). If you are not required to file a return,

mail this form and a letter requesting a refund to Michigan Department of Treasury, P.O. Box 30427, Lansing, MI 48909.

Call (517) 636-6925 if you have any questions.

LINE - by - LINE INsTRuCTIONs

Line 1: Enter your account number.

Line 6: Discounts do not apply to the credit claimed on this form.

Line 2: The advanced prepaid credit is only available for the March

Line 7: Amount entered should equal line 5 entry.

2013 return period.

Line 8: Enter total of sales tax prepaid on diesel fuel (line 5)

Line 3: Enter the name (individual, partners or corporation) under

and discount (line 6). Net payment due. Subtract line 7 from

which the business is registered.

line 4 and enter the difference. This is your net payment due.

Make your check for this amount rather than the amount shown

Line 4: Total amount due. Enter the total amount due from the

on your Combined Return for Michigan Taxes (Form 160)

Total Payment line of the Combined Return for Michigan Taxes

or Discount Voucher for Sales and Use Taxes (Form 161).

(Form 160) or the Total Payment line of Discount Voucher for

DO NOT WRITE THIS AMOUNT ON YOUR RETURN. Send this

Sales and Use Taxes (Form 161).

form with your payment and voucher or return to the address for

filing your combined return. If line 7 is more than line 4, use the

Line 5: Enter total prepaid sales tax on diesel fuel for this return

period. NOTE: The number of diesel fuel gallons purchased and

credit against your next return.

amount of dollars prepaid should be determined by your purchase

invoices for this period.

Reset Form

Michigan Department of Treasury

This form is issued under authority of P.A. 1 of 2013.

5042 (04-13)

Filing is voluntary but must be filed for claim to be allowed.

2013 Diesel Fuel Advanced Prepaid Credit

1. Account Number:

2. Return Period: Month(s)

Year

March

2013

3. Registered Owner’s Name

4. Total Amount Due. Enter amount from Form 160, Combined Return

(Total Payment line) or Form 161, Discount Voucher (Total Payment line) ........................................................4.

5. Total prepaid sales tax on diesel fuel for March 2013.

Enter number of gallons of diesel fuel for this period_________________ ..........

5.

6. Sales tax collection discount. ........................................................................................... 6.

N/A

7. Add sales tax prepaid (line 5) and discount (line 6) .......................................................... 7.

8. Net Amount Due. Subtract line 7 from line 4. .....................................................................................................8.

Complete reverse side. Attach this form to your March 2013 Combined Return (Form 160) or Discount Voucher (Form 161). If no return is required, mail

this form and a letter requesting a refund to Michigan Department of Treasury, P.O. Box 30427, Lansing, MI 48909. For questions, call (517) 636-6925.

1

1