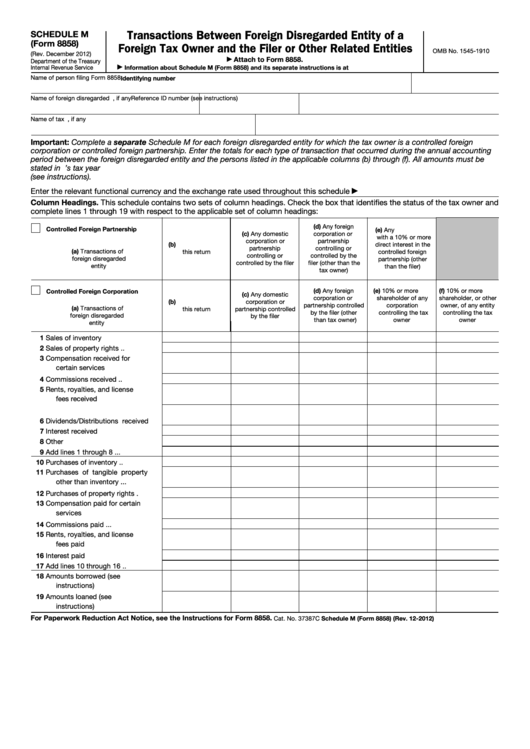

Transactions Between Foreign Disregarded Entity of a

SCHEDULE M

(Form 8858)

Foreign Tax Owner and the Filer or Other Related Entities

OMB No. 1545-1910

(Rev. December 2012)

Attach to Form 8858.

▶

Department of the Treasury

Internal Revenue Service

Information about Schedule M (Form 8858) and its separate instructions is at

▶

Name of person filing Form 8858

Identifying number

Name of foreign disregarded entity

U.S. identifying number, if any

Reference ID number (see instructions)

Name of tax owner

U.S. identifying number, if any

Important: Complete a separate Schedule M for each foreign disregarded entity for which the tax owner is a controlled foreign

corporation or controlled foreign partnership. Enter the totals for each type of transaction that occurred during the annual accounting

period between the foreign disregarded entity and the persons listed in the applicable columns (b) through (f). All amounts must be

stated in U.S. dollars translated from functional currency at the appropriate exchange rate for the foreign disregarded entity’s tax year

(see instructions).

Enter the relevant functional currency and the exchange rate used throughout this schedule

▶

Column Headings. This schedule contains two sets of column headings. Check the box that identifies the status of the tax owner and

complete lines 1 through 19 with respect to the applicable set of column headings:

(d) Any foreign

Controlled Foreign Partnership

(e) Any U.S. person

(c) Any domestic

corporation or

with a 10% or more

corporation or

partnership

(b) U.S. person filing

direct interest in the

partnership

controlling or

(a) Transactions of

this return

controlled foreign

controlling or

controlled by the

foreign disregarded

partnership (other

controlled by the filer

filer (other than the

entity

than the filer)

tax owner)

(d) Any foreign

(e) 10% or more U.S.

(f) 10% or more U.S.

Controlled Foreign Corporation

(c) Any domestic

corporation or

shareholder of any

shareholder, or other

(b) U.S. person filing

corporation or

partnership controlled

corporation

owner, of any entity

(a) Transactions of

this return

partnership controlled

by the filer (other

controlling the tax

controlling the tax

foreign disregarded

by the filer

than tax owner)

owner

owner

entity

1

Sales of inventory .

.

.

.

2

Sales of property rights .

.

3

Compensation

received

for

certain services

.

.

.

.

4

Commissions received

.

.

5

Rents, royalties, and license

fees received .

.

.

.

.

6

Dividends/Distributions received

7

Interest received .

.

.

.

8

Other

.

.

.

.

.

.

.

9

Add lines 1 through 8 .

.

.

10

Purchases of inventory

.

.

11

Purchases of tangible property

other than inventory .

.

.

12

Purchases of property rights .

13

Compensation paid for certain

services

.

.

.

.

.

.

14

Commissions paid

.

.

.

15

Rents, royalties, and license

fees paid

.

.

.

.

.

.

16

Interest paid

.

.

.

.

.

17

Add lines 10 through 16 .

.

18

Amounts

borrowed

(see

instructions)

.

.

.

.

.

19

Amounts

loaned

(see

instructions)

.

.

.

.

.

For Paperwork Reduction Act Notice, see the Instructions for Form 8858.

Cat. No. 37387C

Schedule M (Form 8858) (Rev. 12-2012)

1

1