Save

Print

Clear

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

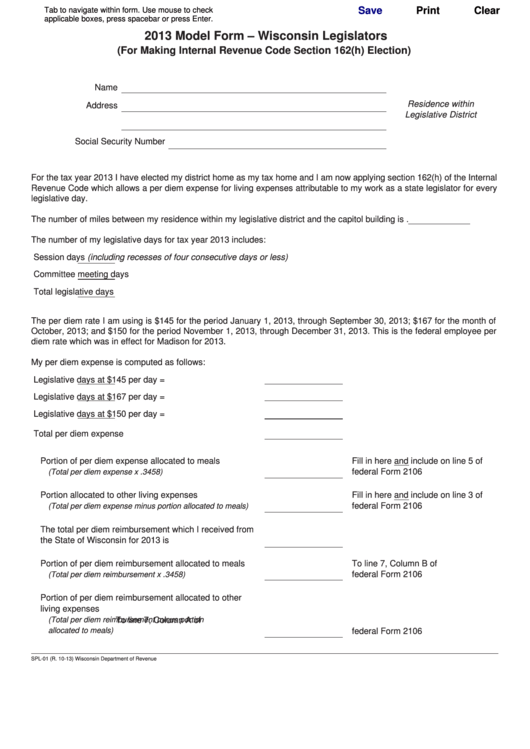

2013 Model Form – Wisconsin Legislators

(For Making Internal Revenue Code Section 162(h) Election)

Name

Residence within

Address

Legislative District

Social Security Number

For the tax year 2013 I have elected my district home as my tax home and I am now applying section 162(h) of the Internal

Revenue Code which allows a per diem expense for living expenses attributable to my work as a state legislator for every

legislative day.

The number of miles between my residence within my legislative district and the capitol building is

.

The number of my legislative days for tax year 2013 includes:

Session days (including recesses of four consecutive days or less)

Committee meeting days

Total legislative days

The per diem rate I am using is $145 for the period January 1, 2013, through September 30, 2013; $167 for the month of

October, 2013; and $150 for the period November 1, 2013, through December 31, 2013. This is the federal employee per

diem rate which was in effect for Madison for 2013.

My per diem expense is computed as follows:

Legislative days at $145 per day =

Legislative days at $167 per day =

Legislative days at $150 per day =

Total per diem expense

Portion of per diem expense allocated to meals

Fill in here and include on line 5 of

federal Form 2106

(Total per diem expense x .3458) . . . . . . . . . . . . . . . . . . . . . .

Portion allocated to other living expenses

Fill in here and include on line 3 of

federal Form 2106

(Total per diem expense minus portion allocated to meals)

The total per diem reimbursement which I received from

the State of Wisconsin for 2013 is . . . . . . . . . . . . . . . . . .

Portion of per diem reimbursement allocated to meals

To line 7, Column B of

. . . . . . . . . . . . . . .

federal Form 2106

(Total per diem reimbursement x .3458)

Portion of per diem reimbursement allocated to other

living expenses

(Total per diem reimbursement minus portion

To line 7, Column A of

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

allocated to meals)

federal Form 2106

SPL-01 (R. 10-13)

Wisconsin Department of Revenue

1

1