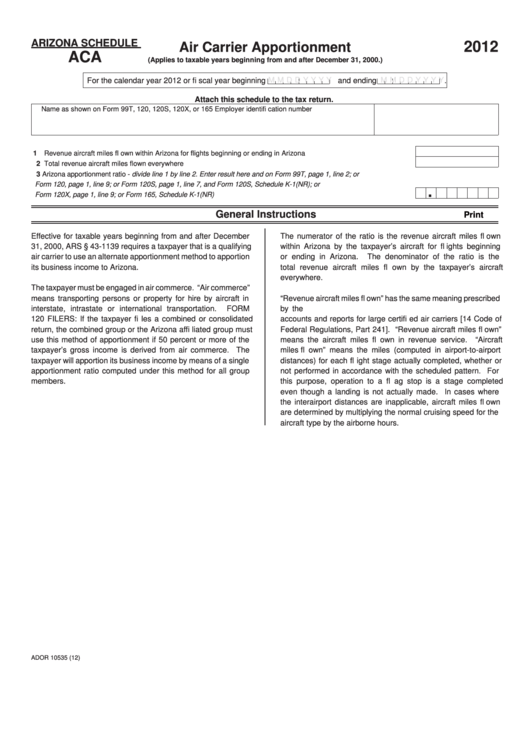

ARIZONA SCHEDULE

2012

Air Carrier Apportionment

ACA

(Applies to taxable years beginning from and after December 31, 2000.)

M M D D Y Y Y Y

M M D D Y Y Y Y

For the calendar year 2012 or fi scal year beginning

and ending

.

Attach this schedule to the tax return.

Name as shown on Form 99T, 120, 120S, 120X, or 165

Employer identifi cation number

1 Revenue aircraft miles fl own within Arizona for fl ights beginning or ending in Arizona .......................................................

2 Total revenue aircraft miles fl own everywhere ......................................................................................................................

3 Arizona apportionment ratio - divide line 1 by line 2. Enter result here and on Form 99T, page 1, line 2; or

Form 120, page 1, line 9; or Form 120S, page 1, line 7, and Form 120S, Schedule K-1(NR); or

.

Form 120X, page 1, line 9; or Form 165, Schedule K-1(NR) ..................................................................................................

General Instructions

Print

Effective for taxable years beginning from and after December

The numerator of the ratio is the revenue aircraft miles fl own

within Arizona by the taxpayer’s aircraft for fl ights beginning

31, 2000, ARS § 43-1139 requires a taxpayer that is a qualifying

air carrier to use an alternate apportionment method to apportion

or ending in Arizona.

The denominator of the ratio is the

its business income to Arizona.

total revenue aircraft miles fl own by the taxpayer’s aircraft

everywhere.

The taxpayer must be engaged in air commerce. “Air commerce”

means transporting persons or property for hire by aircraft in

“Revenue aircraft miles fl own” has the same meaning prescribed

interstate, intrastate or international transportation.

FORM

by the U.S. Department of Transportation uniform system of

120 FILERS: If the taxpayer fi les a combined or consolidated

accounts and reports for large certifi ed air carriers [14 Code of

return, the combined group or the Arizona affi liated group must

Federal Regulations, Part 241]. “Revenue aircraft miles fl own”

use this method of apportionment if 50 percent or more of the

means the aircraft miles fl own in revenue service. “Aircraft

taxpayer’s gross income is derived from air commerce. The

miles fl own” means the miles (computed in airport-to-airport

taxpayer will apportion its business income by means of a single

distances) for each fl ight stage actually completed, whether or

apportionment ratio computed under this method for all group

not performed in accordance with the scheduled pattern. For

members.

this purpose, operation to a fl ag stop is a stage completed

even though a landing is not actually made. In cases where

the interairport distances are inapplicable, aircraft miles fl own

are determined by multiplying the normal cruising speed for the

aircraft type by the airborne hours.

ADOR 10535 (12)

1

1