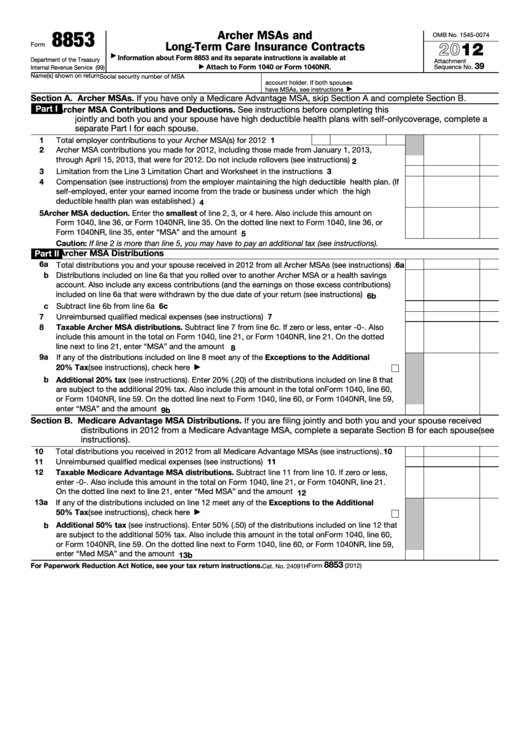

8853

Archer MSAs and

OMB No. 1545-0074

2012

Long-Term Care Insurance Contracts

Form

Information about Form 8853 and its separate instructions is available at

▶

Department of the Treasury

Attachment

39

Attach to Form 1040 or Form 1040NR.

Sequence No.

Internal Revenue Service (99)

▶

Name(s) shown on return

Social security number of MSA

account holder. If both spouses

have MSAs, see instructions

▶

Section A. Archer MSAs. If you have only a Medicare Advantage MSA, skip Section A and complete Section B.

Part I

Archer MSA Contributions and Deductions. See instructions before completing this part. If you are filing

jointly and both you and your spouse have high deductible health plans with self-only coverage, complete a

separate Part I for each spouse.

1

Total employer contributions to your Archer MSA(s) for 2012 .

.

.

.

1

2

Archer MSA contributions you made for 2012, including those made from January 1, 2013,

through April 15, 2013, that were for 2012. Do not include rollovers (see instructions) .

.

.

.

.

2

3

Limitation from the Line 3 Limitation Chart and Worksheet in the instructions

.

.

.

.

.

.

.

3

4

Compensation (see instructions) from the employer maintaining the high deductible health plan. (If

self-employed, enter your earned income from the trade or business under which the high

deductible health plan was established.)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

Archer MSA deduction. Enter the smallest of line 2, 3, or 4 here. Also include this amount on

Form 1040, line 36, or Form 1040NR, line 35. On the dotted line next to Form 1040, line 36, or

Form 1040NR, line 35, enter “MSA” and the amount .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Caution: If line 2 is more than line 5, you may have to pay an additional tax (see instructions).

Archer MSA Distributions

Part II

6a Total distributions you and your spouse received in 2012 from all Archer MSAs (see instructions) .

6a

b Distributions included on line 6a that you rolled over to another Archer MSA or a health savings

account. Also include any excess contributions (and the earnings on those excess contributions)

included on line 6a that were withdrawn by the due date of your return (see instructions) .

.

.

.

6b

c Subtract line 6b from line 6a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6c

7

Unreimbursed qualified medical expenses (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Taxable Archer MSA distributions. Subtract line 7 from line 6c. If zero or less, enter -0-. Also

include this amount in the total on Form 1040, line 21, or Form 1040NR, line 21. On the dotted

line next to line 21, enter “MSA” and the amount .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9a If any of the distributions included on line 8 meet any of the Exceptions to the Additional

20% Tax (see instructions), check here .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

b Additional 20% tax (see instructions). Enter 20% (.20) of the distributions included on line 8 that

are subject to the additional 20% tax. Also include this amount in the total on Form 1040, line 60,

or Form 1040NR, line 59. On the dotted line next to Form 1040, line 60, or Form 1040NR, line 59,

enter “MSA” and the amount

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9b

Section B. Medicare Advantage MSA Distributions. If you are filing jointly and both you and your spouse received

distributions in 2012 from a Medicare Advantage MSA, complete a separate Section B for each spouse (see

instructions).

10

Total distributions you received in 2012 from all Medicare Advantage MSAs (see instructions) .

.

10

11

11

Unreimbursed qualified medical expenses (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

12

Taxable Medicare Advantage MSA distributions. Subtract line 11 from line 10. If zero or less,

enter -0-. Also include this amount in the total on Form 1040, line 21, or Form 1040NR, line 21.

On the dotted line next to line 21, enter “Med MSA” and the amount

.

.

.

.

.

.

.

.

.

.

12

13a If any of the distributions included on line 12 meet any of the Exceptions to the Additional

50% Tax (see instructions), check here .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

b Additional 50% tax (see instructions). Enter 50% (.50) of the distributions included on line 12 that

are subject to the additional 50% tax. Also include this amount in the total on Form 1040, line 60,

or Form 1040NR, line 59. On the dotted line next to Form 1040, line 60, or Form 1040NR, line 59,

enter “Med MSA” and the amount .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13b

8853

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2012)

Cat. No. 24091H

1

1 2

2