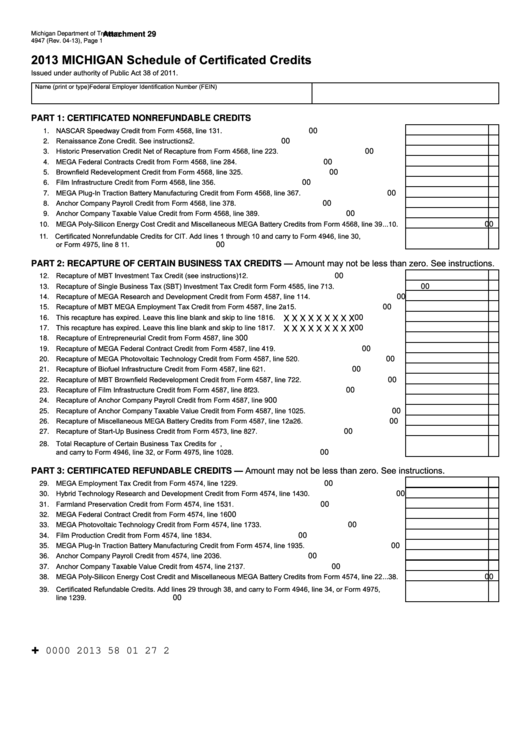

Form 4947 - Michigan Schedule Of Certificated Credits - 2013

ADVERTISEMENT

Michigan Department of Treasury

Attachment 29

4947 (Rev. 04-13), Page 1

2013 MICHIGAN Schedule of Certificated Credits

Issued under authority of Public Act 38 of 2011.

Name (print or type)

Federal Employer Identification Number (FEIN)

PART 1: CERTIFICATED NONREFUNDABLE CREDITS

1. NASCAR Speedway Credit from Form 4568, line 13 ........................................................................................

00

1.

2. Renaissance Zone Credit. See instructions ......................................................................................................

00

2.

3. Historic Preservation Credit Net of Recapture from Form 4568, line 22 ...........................................................

00

3.

4. MEGA Federal Contracts Credit from Form 4568, line 28 .................................................................................

00

4.

5. Brownfield Redevelopment Credit from Form 4568, line 32 ..............................................................................

00

5.

6. Film Infrastructure Credit from Form 4568, line 35 ............................................................................................

00

6.

7. MEGA Plug-In Traction Battery Manufacturing Credit from Form 4568, line 36 ................................................

00

7.

8. Anchor Company Payroll Credit from Form 4568, line 37 .................................................................................

00

8.

9. Anchor Company Taxable Value Credit from Form 4568, line 38 ......................................................................

00

9.

10. MEGA Poly-Silicon Energy Cost Credit and Miscellaneous MEGA Battery Credits from Form 4568, line 39 ...

00

10.

11. Certificated Nonrefundable Credits for CIT. Add lines 1 through 10 and carry to Form 4946, line 30,

or Form 4975, line 8 .........................................................................................................................................

00

11.

PART 2: RECAPTURE OF CERTAIN BUSINESS TAX CREDITS — Amount may not be less than zero. See instructions.

12. Recapture of MBT Investment Tax Credit (see instructions) .............................................................................

00

12.

13. Recapture of Single Business Tax (SBT) Investment Tax Credit form Form 4585, line 7 .................................

00

13.

14. Recapture of MEGA Research and Development Credit from Form 4587, line 1 .............................................

00

14.

15. Recapture of MBT MEGA Employment Tax Credit from Form 4587, line 2a .....................................................

00

15.

16. This recapture has expired. Leave this line blank and skip to line 18 ...............................................................

00

16.

X X X X X X X X X

17. This recapture has expired. Leave this line blank and skip to line 18 ...............................................................

00

17.

X X X X X X X X X

18. Recapture of Entrepreneurial Credit from Form 4587, line 3.............................................................................

00

18.

19. Recapture of MEGA Federal Contract Credit from Form 4587, line 4 ...............................................................

00

19.

20. Recapture of MEGA Photovoltaic Technology Credit from Form 4587, line 5 ...................................................

00

20.

21. Recapture of Biofuel Infrastructure Credit from Form 4587, line 6 ....................................................................

00

21.

22. Recapture of MBT Brownfield Redevelopment Credit from Form 4587, line 7 ..................................................

00

22.

23. Recapture of Film Infrastructure Credit from Form 4587, line 8f .......................................................................

00

23.

24. Recapture of Anchor Company Payroll Credit from Form 4587, line 9..............................................................

00

24.

25. Recapture of Anchor Company Taxable Value Credit from Form 4587, line 10 ................................................

00

25.

26. Recapture of Miscellaneous MEGA Battery Credits from Form 4587, line 12a .................................................

00

26.

27. Recapture of Start-Up Business Credit from Form 4573, line 8 ........................................................................

00

27.

28. Total Recapture of Certain Business Tax Credits for CIT. Add lines 12 through 15 and lines 18 through 27,

and carry to Form 4946, line 32, or Form 4975, line 10 ....................................................................................

00

28.

PART 3: CERTIFICATED REFUNDABLE CREDITS — Amount may not be less than zero. See instructions.

29. MEGA Employment Tax Credit from Form 4574, line 12 ...................................................................................

00

29.

30. Hybrid Technology Research and Development Credit from Form 4574, line 14 ..............................................

00

30.

31. Farmland Preservation Credit from Form 4574, line 15 ....................................................................................

00

31.

32. MEGA Federal Contract Credit from Form 4574, line 16...................................................................................

00

32.

33. MEGA Photovoltaic Technology Credit from Form 4574, line 17 .......................................................................

00

33.

34. Film Production Credit from Form 4574, line 18 ................................................................................................

00

34.

35. MEGA Plug-In Traction Battery Manufacturing Credit from Form 4574, line 19 ................................................

00

35.

36. Anchor Company Payroll Credit from 4574, line 20 ..........................................................................................

00

36.

37. Anchor Company Taxable Value Credit from 4574, line 21 ...............................................................................

00

37.

38. MEGA Poly-Silicon Energy Cost Credit and Miscellaneous MEGA Battery Credits from Form 4574, line 22 ...

00

38.

39. Certificated Refundable Credits. Add lines 29 through 38, and carry to Form 4946, line 34, or Form 4975,

00

line 12 ................................................................................................................................................................

39.

+

0000 2013 58 01 27 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7