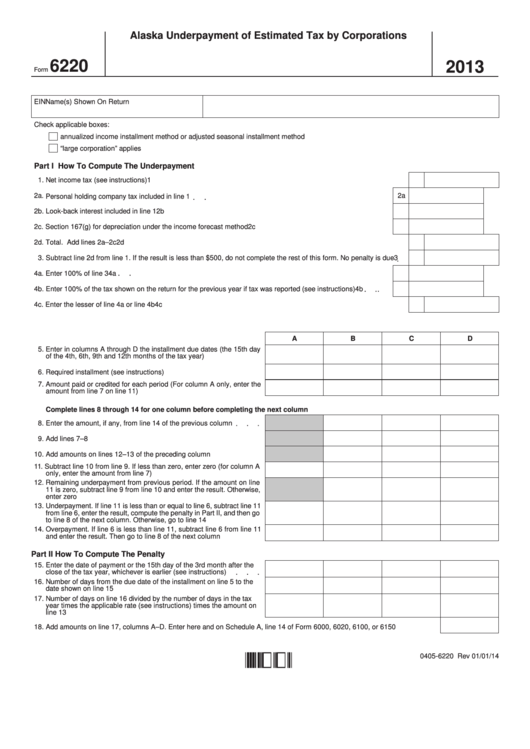

Alaska Underpayment of Estimated Tax by Corporations

6220

2013

Form

EIN

Name(s) Shown On Return

Check applicable boxes:

annualized income installment method or adjusted seasonal installment method

“large corporation” applies

Part I How To Compute The Underpayment

1. Net income tax (see instructions)

1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2a. Personal holding company tax included in line 1

2a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2b. Look-back interest included in line 1

2b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2c. Section 167(g) for depreciation under the income forecast method

2c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2d. Total. Add lines 2a–2c

2d

3. Subtract line 2d from line 1. If the result is less than $500, do not complete the rest of this form. No penalty is due

3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4a. Enter 100% of line 3

4a

.

.

.

4b. Enter 100% of the tax shown on the return for the previous year if tax was reported (see instructions)

4b

4c. Enter the lesser of line 4a or line 4b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4c

A

B

C

D

5. Enter in columns A through D the installment due dates (the 15th day

of the 4th, 6th, 9th and 12th months of the tax year)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6. Required installment (see instructions)

7. Amount paid or credited for each period (For column A only, enter the

amount from line 7 on line 11)

.

.

.

.

.

.

.

.

.

.

.

.

Complete lines 8 through 14 for one column before completing the next column

.

.

.

8. Enter the amount, if any, from line 14 of the previous column

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9. Add lines 7–8

.

.

.

.

.

10. Add amounts on lines 12–13 of the preceding column

11. Subtract line 10 from line 9. If less than zero, enter zero (for column A

.

.

.

.

.

.

.

.

.

.

only, enter the amount from line 7)

12. Remaining underpayment from previous period. If the amount on line

11 is zero, subtract line 9 from line 10 and enter the result. Otherwise,

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

enter zero

13. Underpayment. If line 11 is less than or equal to line 6, subtract line 11

from line 6, enter the result, compute the penalty in Part II, and then go

.

.

.

.

.

to line 8 of the next column. Otherwise, go to line 14

14. Overpayment. If line 6 is less than line 11, subtract line 6 from line 11

.

.

.

.

and enter the result. Then go to line 8 of the next column

Part II How To Compute The Penalty

15. Enter the date of payment or the 15th day of the 3rd month after the

close of the tax year, whichever is earlier (see instructions)

.

.

.

16. Number of days from the due date of the installment on line 5 to the

.

.

.

.

.

.

.

.

.

.

.

.

.

.

date shown on line 15

17. Number of days on line 16 divided by the number of days in the tax

year times the applicable rate (see instructions) times the amount on

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

line 13

.

.

.

.

18. Add amounts on line 17, columns A–D. Enter here and on Schedule A, line 14 of Form 6000, 6020, 6100, or 6150

6220:01 01 14

0405-6220 Rev 01/01/14

1

1