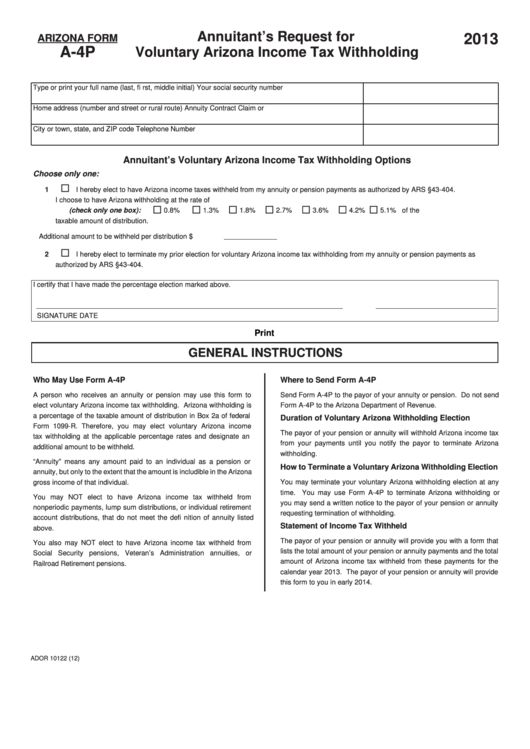

Annuitant’s Request for

2013

ARIZONA FORM

A-4P

Voluntary Arizona Income Tax Withholding

Type or print your full name (last, fi rst, middle initial)

Your social security number

Home address (number and street or rural route)

Annuity Contract Claim or I.D. Number

City or town, state, and ZIP code

Telephone Number

Annuitant’s Voluntary Arizona Income Tax Withholding Options

Choose only one:

1

I hereby elect to have Arizona income taxes withheld from my annuity or pension payments as authorized by ARS §43-404.

I choose to have Arizona withholding at the rate of

(check only one box):

0.8%

1.3%

1.8%

2.7%

3.6%

4.2%

5.1% of the

taxable amount of distribution.

Additional amount to be withheld per distribution $

2

I hereby elect to terminate my prior election for voluntary Arizona income tax withholding from my annuity or pension payments as

authorized by ARS §43-404.

I certify that I have made the percentage election marked above.

SIGNATURE

DATE

Print

GENERAL INSTRUCTIONS

Who May Use Form A-4P

Where to Send Form A-4P

A person who receives an annuity or pension may use this form to

Send Form A-4P to the payor of your annuity or pension. Do not send

elect voluntary Arizona income tax withholding. Arizona withholding is

Form A-4P to the Arizona Department of Revenue.

a percentage of the taxable amount of distribution in Box 2a of federal

Duration of Voluntary Arizona Withholding Election

Form 1099-R. Therefore, you may elect voluntary Arizona income

The payor of your pension or annuity will withhold Arizona income tax

tax withholding at the applicable percentage rates and designate an

from your payments until you notify the payor to terminate Arizona

additional amount to be withheld.

withholding.

“Annuity” means any amount paid to an individual as a pension or

How to Terminate a Voluntary Arizona Withholding Election

annuity, but only to the extent that the amount is includible in the Arizona

You may terminate your voluntary Arizona withholding election at any

gross income of that individual.

time. You may use Form A-4P to terminate Arizona withholding or

You may NOT elect to have Arizona income tax withheld from

you may send a written notice to the payor of your pension or annuity

nonperiodic payments, lump sum distributions, or individual retirement

requesting termination of withholding.

account distributions, that do not meet the defi nition of annuity listed

Statement of Income Tax Withheld

above.

The payor of your pension or annuity will provide you with a form that

You also may NOT elect to have Arizona income tax withheld from

lists the total amount of your pension or annuity payments and the total

Social Security pensions, Veteran’s Administration annuities, or

amount of Arizona income tax withheld from these payments for the

Railroad Retirement pensions.

calendar year 2013. The payor of your pension or annuity will provide

this form to you in early 2014.

ADOR 10122 (12)

1

1