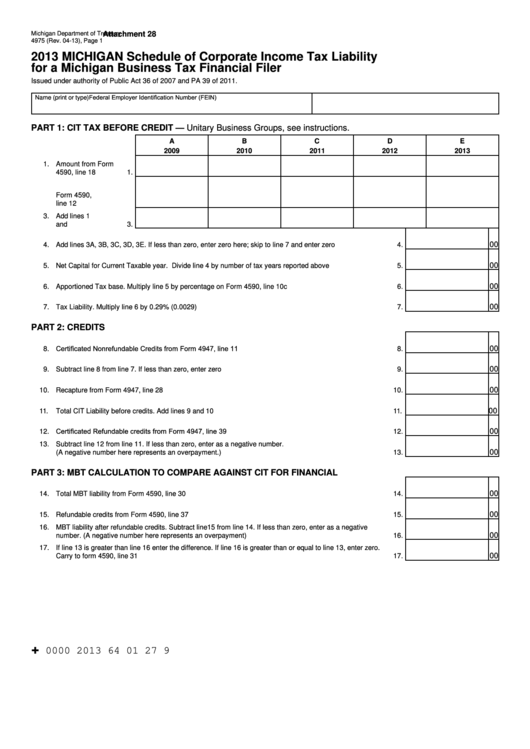

Michigan Department of Treasury

Attachment 28

4975 (Rev. 04-13), Page 1

2013 MICHIGAN Schedule of Corporate Income Tax Liability

for a Michigan Business Tax Financial Filer

Issued under authority of Public Act 36 of 2007 and PA 39 of 2011.

Federal Employer Identification Number (FEIN)

Name (print or type)

PART 1: CIT TAX BEFORE CREDIT — Unitary Business Groups, see instructions.

A

B

C

D

E

2009

2010

2011

2012

2013

1. Amount from Form

4590, line 18 .........

1.

2. Goodwill from

Form 4590,

line 12 ...................

2.

3. Add lines 1

and 2.....................

3.

00

4. Add lines 3A, 3B, 3C, 3D, 3E. If less than zero, enter zero here; skip to line 7 and enter zero .........................

4.

00

5. Net Capital for Current Taxable year. Divide line 4 by number of tax years reported above .............................

5.

00

6. Apportioned Tax base. Multiply line 5 by percentage on Form 4590, line 10c ...................................................

6.

00

7. Tax Liability. Multiply line 6 by 0.29% (0.0029) ...................................................................................................

7.

PART 2: CREDITS

8. Certificated Nonrefundable Credits from Form 4947, line 11 .............................................................................

00

8.

00

9. Subtract line 8 from line 7. If less than zero, enter zero .....................................................................................

9.

00

10. Recapture from Form 4947, line 28 ....................................................................................................................

10.

00

11. Total CIT Liability before credits. Add lines 9 and 10 ..........................................................................................

11.

12. Certificated Refundable credits from Form 4947, line 39 ...................................................................................

00

12.

13. Subtract line 12 from line 11. If less than zero, enter as a negative number.

00

(A negative number here represents an overpayment.) .....................................................................................

13.

PART 3: MBT CALCULATION TO COMPARE AGAINST CIT FOR FINANCIAL

00

14. Total MBT liability from Form 4590, line 30 ........................................................................................................

14.

00

15. Refundable credits from Form 4590, line 37 ......................................................................................................

15.

16. MBT liability after refundable credits. Subtract line15 from line 14. If less than zero, enter as a negative

00

number. (A negative number here represents an overpayment) ........................................................................

16.

17. If line 13 is greater than line 16 enter the difference. If line 16 is greater than or equal to line 13, enter zero.

00

Carry to form 4590, line 31 .................................................................................................................................

17.

+

0000 2013 64 01 27 9

1

1 2

2