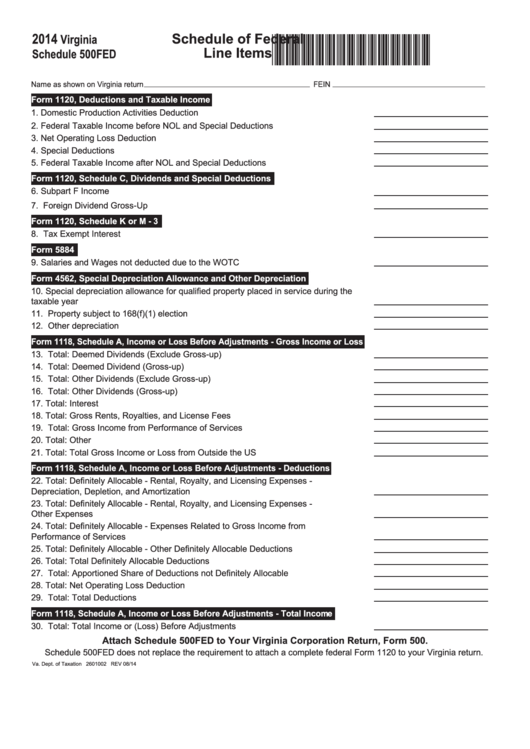

2014

Schedule of Federal

Virginia

*VASFED114888*

Line Items

Schedule 500FED

Name as shown on Virginia return

FEIN

Form 1120, Deductions and Taxable Income

1. Domestic Production Activities Deduction ................................................................... 1

.00

2. Federal Taxable Income before NOL and Special Deductions ................................... 2

.00

3. Net Operating Loss Deduction ................................................................................... 3

.00

4. Special Deductions ..................................................................................................... 4

.00

5. Federal Taxable Income after NOL and Special Deductions ..................................... 5

.00

Form 1120, Schedule C, Dividends and Special Deductions

6. Subpart F Income ....................................................................................................... 6

.00

7. Foreign Dividend Gross-Up ........................................................................................ 7

.00

Form 1120, Schedule K or M - 3

8. Tax Exempt Interest .................................................................................................... 8

.00

Form 5884

9. Salaries and Wages not deducted due to the WOTC ................................................. 9

.00

Form 4562, Special Depreciation Allowance and Other Depreciation

10. Special depreciation allowance for qualified property placed in service during the

taxable year

.......................................................................................................... 10

.00

11. Property subject to 168(f)(1) election .........................................................................11

.00

12. Other depreciation ................................................................................................... 12

.00

Form 1118, Schedule A, Income or Loss Before Adjustments - Gross Income or Loss

13. Total: Deemed Dividends (Exclude Gross-up) .......................................................... 13

.00

14. Total: Deemed Dividend (Gross-up) ......................................................................... 14

.00

15. Total: Other Dividends (Exclude Gross-up) ............................................................... 15

.00

16. Total: Other Dividends (Gross-up) ............................................................................ 16

.00

17. Total: Interest ........................................................................................................... 17

.00

18. Total: Gross Rents, Royalties, and License Fees ..................................................... 18

.00

19. Total: Gross Income from Performance of Services ................................................. 19

.00

20. Total: Other .............................................................................................................. 20

.00

21. Total: Total Gross Income or Loss from Outside the US ........................................... 21

.00

Form 1118, Schedule A, Income or Loss Before Adjustments - Deductions

22. Total: Definitely Allocable - Rental, Royalty, and Licensing Expenses -

Depreciation, Depletion, and Amortization ................................................................ 22

.00

23. Total: Definitely Allocable - Rental, Royalty, and Licensing Expenses -

Other Expenses ........................................................................................................ 23

.00

24. Total: Definitely Allocable - Expenses Related to Gross Income from

Performance of Services ........................................................................................... 24

.00

25. Total: Definitely Allocable - Other Definitely Allocable Deductions ............................ 25

.00

26. Total: Total Definitely Allocable Deductions ............................................................... 26

.00

27. Total: Apportioned Share of Deductions not Definitely Allocable ............................. 27

.00

28. Total: Net Operating Loss Deduction ........................................................................ 28

.00

29. Total: Total Deductions ............................................................................................. 29

.00

Form 1118, Schedule A, Income or Loss Before Adjustments - Total Income or Loss

30. Total: Total Income or (Loss) Before Adjustments ..................................................... 30

.00

Attach Schedule 500FED to Your Virginia Corporation Return, Form 500.

Schedule 500FED does not replace the requirement to attach a complete federal Form 1120 to your Virginia return.

Va. Dept. of Taxation 2601002 REV 08/14

1

1