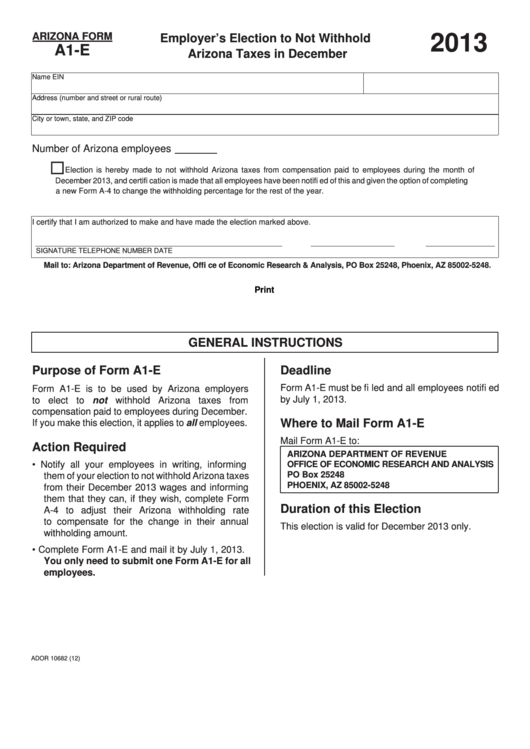

ARIZONA FORM

2013

Employer’s Election to Not Withhold

A1-E

Arizona Taxes in December

Name

EIN

Address (number and street or rural route)

City or town, state, and ZIP code

Number of Arizona employees

Election is hereby made to not withhold Arizona taxes from compensation paid to employees during the month of

December 2013, and certifi cation is made that all employees have been notifi ed of this and given the option of completing

a new Form A-4 to change the withholding percentage for the rest of the year.

I certify that I am authorized to make and have made the election marked above.

SIGNATURE

TELEPHONE NUMBER

DATE

Mail to: Arizona Department of Revenue, Offi ce of Economic Research & Analysis, PO Box 25248, Phoenix, AZ 85002-5248.

Print

GENERAL INSTRUCTIONS

Purpose of Form A1-E

Deadline

Form A1-E must be fi led and all employees notifi ed

Form A1-E is to be used by Arizona employers

by July 1, 2013.

to elect to not withhold Arizona taxes from

compensation paid to employees during December.

Where to Mail Form A1-E

If you make this election, it applies to all employees.

Mail Form A1-E to:

Action Required

ARIZONA DEPARTMENT OF REVENUE

• Notify all your employees in writing, informing

OFFICE OF ECONOMIC RESEARCH AND ANALYSIS

PO Box 25248

them of your election to not withhold Arizona taxes

PHOENIX, AZ 85002-5248

from their December 2013 wages and informing

them that they can, if they wish, complete Form

Duration of this Election

A-4 to adjust their Arizona withholding rate

to compensate for the change in their annual

This election is valid for December 2013 only.

withholding amount.

• Complete Form A1-E and mail it by July 1, 2013.

You only need to submit one Form A1-E for all

employees.

ADOR 10682 (12)

1

1