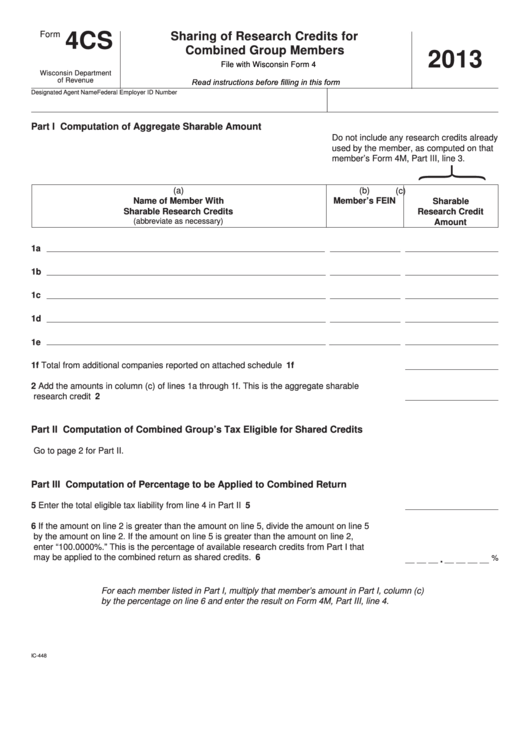

Form 4cs - Sharing Of Research Credits For Combined Group Members - 2013

ADVERTISEMENT

Form

4CS

Sharing of Research Credits for

Combined Group Members

2013

File with Wisconsin Form 4

Wisconsin Department

Read instructions before filling in this form

of Revenue

Designated Agent Name

Federal Employer ID Number

Part I Computation of Aggregate Sharable Amount

Do not include any research credits already

used by the member, as computed on that

member’s Form 4M, Part III, line 3.

(a)

(b)

(c)

Name of Member With

Member’s FEIN

Sharable

Sharable Research Credits

Research Credit

(abbreviate as necessary)

Amount

1a

1b

1c

1d

1e

1f Total from additional companies reported on attached schedule. . . . . . . . . . . . . . . . . . . . . 1f

2

Add the amounts in column (c) of lines 1a through 1f. This is the aggregate sharable

research credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Part II Computation of Combined Group’s Tax Eligible for Shared Credits

Go to page 2 for Part II.

Part III Computation of Percentage to be Applied to Combined Return

5

Enter the total eligible tax liability from line 4 in Part II. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6

If the amount on line 2 is greater than the amount on line 5, divide the amount on line 5

by the amount on line 2. If the amount on line 5 is greater than the amount on line 2,

enter “100.0000%.” This is the percentage of available research credits from Part I that

may be applied to the combined return as shared credits. . . . . . . . . . . . . . . . . . . . . . . . . . 6

.

%

For each member listed in Part I, multiply that member’s amount in Part I, column (c)

by the percentage on line 6 and enter the result on Form 4M, Part III, line 4.

IC-448

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2