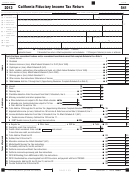

Instructions For Form 541 - California Fiduciary Income Tax Return - 2013 Page 12

ADVERTISEMENT

Part I

California does not conform to qualified small

4. If all of the trustees are nonresidents and

business stock gain exclusion under IRC 1202.

at least one noncontingent beneficiary

Complete lines 1a through 1f before completing

is a California resident and at least one

Line 9 and Line 10 – These lines provide for the

the Income and Deduction Allocation.

noncontingent beneficiary is a nonresident,

computation of the deduction allowable to the

the trust is taxed on all California source

The trustee is required to disclose the number

fiduciary for amounts paid, credited, or required

income plus the proportion of all other

of the trust’s California resident trustees,

to be distributed to the beneficiaries of the estate

income that the number of California resident

nonresident trustees total trustees, California

or trust. The deduction is equal to the amounts

noncontingent beneficiaries bear to the total

resident noncontingent beneficiaries, and total

paid, credited, or required to be distributed

number of noncontingent beneficiaries (R&TC

noncontingent beneficiaries.

or the distributable net income, whichever is

Section 17744). Complete Schedule G.

smaller, adjusted in either case to exclude items

Line 1(a) and Line 1(b) – Provide the total

5. If the trust has resident and nonresident

of tax-exempt income entering into distributable

number of California resident trustees and the

trustees and resident and nonresident

net income. See the instructions for completing

total number of California nonresident trustees

noncontingent beneficiaries, both situations 3

federal Form 1041, Schedule B, Income

who served the trust during any portion of the

and 4 apply. Complete Schedule G.

Distribution Deduction, and attach Schedule J

trust’s taxable year. If a trustee ceased to serve

(541), Trust Allocation of an Accumulation

The R&TC and accompanying regulations do not

the trust during any portion of the taxable year,

Distribution, if required.

discuss the situation where some fiduciaries and

changed residence during the taxable year, or

some beneficiaries are nonresidents (situation 5).

began serving the trust during the taxable year,

Complete and attach to Form 541 a properly

The FTB Legal Ruling No. 238, October 27, 1959,

attach an additional statement identifying the

completed Schedule K-1 (541) for each

provides the method for allocating non-California

particular trustee, the relevant date or dates, and a

beneficiary. An FTB-approved substitute form or

source income where there is a mixture of

description of the event.

the information notice sent to beneficiaries may

California resident and nonresident fiduciaries,

be used if it contains the information required by

Line 1(d) and Line 1(e) – Include only

and California resident and nonresident

Schedule K-1 (541).

noncontingent beneficiaries as provided in R&TC

noncontingent beneficiaries.

Section 17742. If the trust has no California

For more information, see General Information E,

Example: Assume that the total taxable income

resident noncontingent beneficiaries or no

Additional Forms the Fiduciary May Have to File.

of the trust is $90,000 and is not sourced in

nonresident noncontingent beneficiaries, enter -0-

Schedule G

California. There are three trustees, one of

on line 1(d) or line 1(e), respectively.

whom is a resident of California. There are two

California Source Income and

Part II

noncontingent income beneficiaries, one of whom

Deduction Apportionment

is a resident of California. The amount of income

Complete Column A through Column H to

taxable by California is calculated in the following

determine the amounts to enter on Form 541,

Trust Income to be Reported from Sources.

steps:

Side 1, line 1 through line 15b.

Income retained by a trust is taxable to the

1. Taxable income is first allocated to California

Income Allocation

trust. Income from California sources is taxable

by the ratio of the number of California trustees

regardless of the residence of the fiduciaries

Column A:

Enter the California sourced income

to the total number of trustees. The trustee

and beneficiaries. R&TC Section 17742 through

amount for line 1 through line 8.

calculation is 1/3 of $90,000 = $30,000.

Section 17745 provide that the taxability of

2. The amount allocated to California in that ratio

Column B:

Enter the non-California sourced

non-California source income retained by a

(from Step 1) is subtracted from total taxable

income amount for line 1 through

trust and allocated to principal depends on the

income. The amount for the next allocation is

line 8.

residence of the fiduciaries and noncontingent

$60,000 ($90,000 – $30,000).

beneficiaries, not the person who established the

Column C:

Multiply column B by

3. The remainder of total income is then allocated

trust. Contingent beneficiaries are not relevant in

Number of CA trustees

to California by the ratio of the number of

determining the taxability of a trust.

Total number of trustees

California noncontingent beneficiaries to the

A noncontingent or vested beneficiary has an

total number of noncontingent beneficiaries.

Column D:

Subtract column C from column B.

unconditional interest in the trust income or

The beneficiary calculation is 1/2 of $60,000 =

Column E:

Multiply column D by

corpus. If the interest is subject to a condition

$30,000.

Number of CA noncontingent beneficiaries

precedent, something must occur before the

4. The sum of the trustee calculation and the

interest becomes present, it is not counted for

Total number of noncontingent

noncontingent beneficiary calculation is the

beneficiaries

purposes of computing taxable income. Surviving

amount of non-California source income

an existing beneficiary to receive a right to trust

taxable by California. The trustee income

Column F:

Add columns A, C, and E.

income is an example of a condition precedent.

calculation of $30,000 plus the beneficiary

Line 9:

Total lines 1 through 8 for

income calculation of $30,000 equals the

There are five different situations that can occur

column A through column F.

income taxable by California of $60,000.

when determining the taxability of a trust. The

Deduction Allocation

situations and treatment are:

The apportionment described above does not

Column G:

Enter the total amount of deductions

apply when the interest of a beneficiary is

1. If the trustee (or all the trustees, if more

for line 10 through line 15b.

contingent. See R&TC Section 17745 regarding

than one) is a California resident, the trust is

taxability in such cases.

taxed on all income from all sources (R&TC

Column H:

Multiply the amounts in column G,

Section 17742).

If any of the following apply, all trust income is

line 10 through line 15b by

2. If the noncontingent beneficiary (or all the

taxable to California. Do not complete Schedule G.

Line 9, column F

noncontingent beneficiaries, if more than

• All trustees are California residents

Line 9, column A plus B

one) is a California resident, the trust is

• All non-contingent beneficiaries are California

taxed on all income from all sources (R&TC

residents

Section 17742).

• All trust income is from California sources

3. If at least one trustee is a California resident

and at least one trustee is a nonresident and

The amounts transferred from Schedule G,

all beneficiaries are nonresidents, the trust is

column F and column H, should only include

taxed on all California source income plus the

income and deductions reportable to California.

proportion of all other income that the number

of California resident trustees bears to the total

number of trustees (R&TC Section 17743).

Complete Schedule G.

Form 541 Booklet 2013 Page 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12