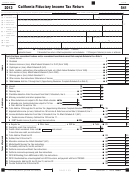

Instructions For Form 541 - California Fiduciary Income Tax Return - 2013 Page 6

ADVERTISEMENT

Energy conservation rebates, vouchers, or other

• Any part of a total distribution shown on

• Taxes computed as an addition to, or

financial incentives are excluded from income.

federal Form 1099-R, Distributions From

percentage of, any taxes not deductible under

Pensions, Annuities, Retirement or Profit-

the law.

Line 4 – Capital gain or (loss)

Sharing Plans, IRAs, Insurance Contracts, etc.,

• Legacy, succession, gift, or inheritance taxes.

Enter from Schedule D (541), Capital Gain or

that is treated as ordinary income.

• Sales and local general sales and use taxes.

Loss, the gain or (loss) from the sale or exchange

of capital assets. See the instructions for

Get California Schedule G-1, Tax on Lump-Sum

Line 12 – Fiduciary fees

Schedule D (541).

Distributions, for more information.

Enter the deductible fees paid to the fiduciary

for administering the estate or trust and other

Line 5 – Rents, royalties, partnerships, other

Deductions

allowable administration costs incurred during the

estates and trusts, etc.

taxable year.

All deductions entered on line 10 through

Enter the total of net rent and royalty income

line 15c must include only the fiduciary’s share of

or (loss) and the total income or (loss) from

Allowable administration costs are those costs

deductions related to taxable income. If the estate

partnerships and other estates, or trusts. Do not

that were incurred in connection with the

or trust has tax-exempt income, the amounts

include amounts for any of the following:

administration of the estate or trust that would

included on line 10 through line 15c must be

not have been incurred if the property were not

• Interest, enter on line 1

reduced by the allocable portion attributed to

held in such estate or trust. These administration

• Dividends, enter on line 2

tax-exempt income. See federal Form 1041

costs are not subject to the 2% floor. Trust

• Capital gain or (loss), enter on Schedule D

instructions, “Allocation of Deductions for

expenses relating to outside investment

(541)

Tax-Exempt Income,’’ for information on how to

advice and investment management fees are

• Ordinary gain or (loss), enter on Schedule D-1,

determine the allocable amount to enter on line 10

miscellaneous itemized deductions subject to the

Sales of Business Property

through line 15c.

2% floor. See instructions for line 15b.

Complete and attach federal Schedule E,

California law follows federal law for:

Line 13 – Charitable deduction

Supplemental Income and Loss, using California

Enter the amount from Form 541, Side 2,

• Fiduciary, attorney, accountant, and return

amounts. Attach form FTB 3885F to report any

Schedule A, line 5.

preparer fees.

depreciation and amortization deduction.

• Limited deductions for losses arising from

Line 14 – Attorney, accountant, and return

Follow federal instructions for “Depreciation,

certain activities.

preparer fees

Depletion, and Amortization,’’ regarding dividing

• Limited deductions for farming syndicates

Enter deductible attorney, accountant, and return

the deductions between the fiduciary and the

that had a change in membership or were

preparer fees paid for the estate or the trust.

beneficiary(ies).

established in 1977 (see IRC Section 464).

Line 15a – Other deductions NOT subject to the

Elections to expense certain depreciable business

• Bankruptcy estates: See Title 11 of the

2% floor

assets under IRC Section 179 and R&TC

USC 346(e) for California deductions allowed

Explain on a separate schedule all other

Sections 17267.2, 17267.6, and 17268 do not

for expenses incurred during administration.

authorized deductions that are not deductible

apply to estates and trusts.

• California law conforms to federal law

elsewhere on Form 541. Enter the total on

relating to the denial of deductions for

Any losses or credits from passive activities

line 15a.

lobbying activities, club dues, and employee

may be limited. See General Information L, for

Include any net interest deduction on interest

remuneration in excess of one million dollars.

information about passive activity loss limitations.

earned on an enterprise zone (EZ) or targeted

Line 10 – Interest

Line 6 – Farm income or (loss)

tax area (TTA) investment that is more than the

Enter any deductible interest paid or incurred that

Enter the net income or (loss) from farming

expense of earning that interest. Attach form

is not deductible elsewhere on Form 541. Attach

during the taxable year. Attach federal Schedule F,

FTB 3805Z, Enterprise Zone Deduction and Credit

a separate schedule showing all interest paid or

Profit or Loss From Farming, using California

Summary, or form FTB 3809, Targeted Tax Area

incurred. Do not include interest on a debt that

amounts. Attach form FTB 3885F to report

Deduction and Credit Summary.

was incurred or continued in order to buy or carry

any depreciation and amortization deduction.

Claim of Right. To claim the deduction, enter

obligations on which the interest is tax-exempt.

Follow federal instructions for “Depreciation,

a deduction of $3,000 or less on line 15b or a

If unpaid interest is due to a related person, get

Depletion, and Amortization’’ regarding dividing

deduction of more than $3,000 on line 15a. If the

federal Publication 936, Home Mortgage Interest

the deductions between the fiduciary and the

fiduciary elects to take the credit instead of the

Deduction, for more information.

beneficiary(ies).

deduction, it should use the California tax rate,

The amount of investment interest deduction is

Line 7 – Ordinary gain or (loss)

add the credit amount to the total on line 33,

limited. Get form FTB 3526, Investment Interest

Enter from Schedule D-1, the gain or (loss)

Total Payments. To the left of this total, write

Expense Deduction, to compute the allowable

from the sale or exchange of property other

“IRC 1341” and the amount of the credit.

investment interest expense deduction. Any

than a capital asset and also from involuntary

Casualty losses. California law generally follows

disallowed investment interest expense is

conversions (other than casualty or theft). Get

federal law. See federal Form 4684, Casualties

allowed as a carryforward to the next taxable

the instructions for Schedule D-1 for more

and Thefts.

year. See IRC Section 163(d) and get federal

information.

Publication 550, Investment Income and

NOL deductions. For taxable years beginning on

Line 8 – Other income

Expenses, for more information.

or after January 1, 2012, California has reinstated

Enter the total taxable income not reported

the NOL deduction.

If the allowable part of the excess investment

elsewhere on Side 1. State the nature of the

interest expense is deductible and a completed

income. Attach a separate sheet if necessary.

For taxable years beginning in 2010 and

form FTB 3526 is required, write “FTB 3526

2011, California suspended the NOL carryover

Examples of income to be reported on line 8

attached” on the dotted line to the left of line 10.

deduction. Taxpayers continued to compute and

include the following:

Then add the deductible investment interest to the

carryover NOLs during the suspension period.

• Unpaid compensation received by the

other types of deductible interest and enter the

However, taxpayers with modified adjusted gross

decedent’s estate that is income in respect of a

total on line 10.

income of less than $300,000 or with disaster

decedent.

loss carryovers were not affected by the NOL

Line 11 – Taxes

• The estate’s or trust’s share of aggregate income

suspension rules.

Enter any deductible property taxes paid or

or loss that is ordinary income, if the estate or

incurred during the taxable year that are not

For more information, see R&TC

trust is a shareholder of an S corporation. Enter

deductible elsewhere on Form 541. Attach a

Sections 17276.05, 17276.20, 17276.21, and

the name and FEIN of the S corporation. Report

separate schedule showing all taxes paid or

17276.22 and get form FTB 3805V, Net Operating

capital gain income, dividend income, etc., on

incurred during the taxable year.

Loss (NOL) Computation and NOL and Disaster

other appropriate lines.

Loss Limitations – Individuals, Estates and Trusts;

Do not deduct:

• The estate’s or trust’s share of taxable income

form FTB 3805Z, Enterprise Zone Deduction and

or (loss) if the estate or trust is a holder of

• Taxes assessed against local benefits that

Credit Summary; form FTB 3807, Local Agency

a residual interest in a REMIC. Beneficiaries

increase the value of the property assessed.

Military Base Recovery Area (LAMBRA) Deduction

should receive Schedule K-1 (541 or 565)

• Income or profit taxes imposed by the federal

and Credit Summary, and form FTB 3809,

and instructions from the REMIC. Get federal

government, any state, or foreign country.

Targeted Tax Area (TTA) Deduction and Credit

Schedule E, Part IV, instructions for reporting

Summary.

requirements; also, attach federal Schedule E.

Form 541 Booklet 2013 Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12