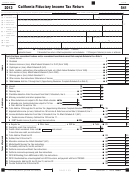

Instructions For Form 541 - California Fiduciary Income Tax Return - 2013 Page 9

ADVERTISEMENT

An estate or trust that has resident/nonresident

If the estate or trust completed the credit

Failure to report and timely pay may result in the

or real estate withholding should only claim the

recapture portion of any of the following forms,

assessment of interest, penalties and fees.

credit if the estate or trust did not distribute the

include the recapture amount on line 34. Write the

See page 5 for a general explanation of California

related income in the current year. If the estate or

form number and the recaptured amount on the

use tax.

trust distributed the related income, the estate or

dotted line to the left of line 34.

Use Tax Worksheet

trust should prepare Form 592 and Form 592-B to

• Form FTB 3540, Credit Carryover and

You must use the Use Tax Worksheet on the next

distribute the credit to the beneficiaries who will

Recapture Summary

page to calculate your use tax liability, if any of

report the taxable income and claim their share of

• Form FTB 3805Z, Enterprise Zone Deduction

the following apply:

the credit on their California income tax returns.

and Credit Summary

If the estate or trust partially distributes the

• You prefer to calculate the amount of use tax

• Form FTB 3807, Local Agency Military Base

income, Form 592 and Form 592-B should show

due based upon your actual purchases subject

Recovery Area (LAMBRA), Deduction and

only the allocated income distribution and related

to use tax, rather than based on an estimate.

Credit Summary

withholding credit. Do not include withholding

• You owe use tax on any item purchased for use

• Form FTB 3808, Manufacturing Enhancement

from other forms on this line or NCNR member’s

in a trade or business not registered with the

Area Credit Summary

tax from Schedule K-1 (568), line 15e on this line.

State Board of Equalization.

• Form FTB 3809, Targeted Tax Area Deduction

• You owe use tax on purchases of individual

and Credit Summary

Line 32 – 2013 CA estimated tax payments,

items with a purchase price of $1,000 or more.

amount applied from 2012 tax return, and

Also, include in the recapture amount on line 34,

Example 1: You purchased a television for

payments with form FTB 3563

if the estate or trust is subject to recapture for the

$2,000 from an out-of state retailer that did

Enter the amount of any estimated tax payment

Community Development Financial Institutions

not collect use tax. You must use the Use Tax

the estate or trust made on Form 541-ES,

Investment Credit.

Worksheet to calculate the use tax due on the

Estimated Tax for Fiduciaries, for 2013. Also, enter

Line 36 – Credit to your 2014 estimated tax

price of the television, since the price of the

the amount of any overpayment from the 2012

Enter the amount from line 35 that the estate or

television is $1,000 or more.

tax return that was applied to the 2013 estimated

trust wants applied to their 2014 estimated tax.

tax. Include payments made with form FTB 3563,

Example 2: You purchased a computer monitor

Line 37 – Amount of overpaid tax available

Payment for Automatic Extension for Fiduciaries.

for $300, a rare coin for $500, and designer

this year

clothing for $250 from an out-of-state retailer

If the estate or trust is a NCNR member of an LLC

If an amount is entered on line 36, subtract it

that did not collect use tax. Although the total

and tax was paid on the estate’s or trust’s behalf

from line 35. Enter the result on line 37. The

price of all the items is $1,050, the price of

by the LLC, include the NCNR members’ tax from

entire amount may be refunded or voluntary

each item is less than $1,000. Since none of

Schedule K-1 (568), line 15e. If you are including

contributions may be made. If the estate or trust

these individual items are $1,000 or more, you

NCNR tax, write “LLC” on the dotted line to

owes use tax, the estate or trust may offset that

are not required to use the Use Tax Worksheet

the left of the amount on line 32, and attach

amount against this balance.

and may choose to use the Estimated Use Tax

Schedule K-1 (568) to the California income tax

Line 38 – Use Tax. This is not a total line.

Lookup Table.

return to claim the tax paid by the LLC on the

You may owe use tax if you make purchases from

estate’s or trust’s behalf.

If you have a combination of individual items

out of state retailers (for example, purchases

purchased for $1,000 or more, and/or items

The trustee (or executor under certain

made by telephone, over the Internet, by mail, or

purchased for use in a trade or business not

circumstances) may elect to allocate to the

in person) where sales or use tax was not paid

registered with the State Board of Equalization,

beneficiary a portion of estimated payments. Use

and you use those items in California. If you have

and individual, non-business items purchased for

Form 541-T, California Allocation of Estimated Tax

questions about whether a purchase is taxable,

less than $1,000, you may either:

Payments to Beneficiaries. Reduce the amount

go to the State Board of Equalization’s website at

of estimated tax payments you are claiming

boe.ca.gov, or call their Customer Service Center

• Use the Use Tax Worksheet to compute use tax

by the amount allocated to the beneficiary on

at 800.400.7115 or California Relay Service (CRS)

due on all purchases, or

Form 541-T.

711 (for hearing and speech disabilities.)

• Use the Use Tax Worksheet to compute use

Estimated tax paid by an individual before death

tax due on all individual items purchased for

Some taxpayers are required to report business

must be claimed on the income tax return filed for

$1,000 or more, plus items purchased for use

purchases subject to use tax directly to the State

the decedent and not on the Form 541 filed for the

in a trade or business, use the Estimated Use

Board of Equalization. However, they may report

decedent’s estate.

Tax Lookup Table to estimate the use tax due

certain personal purchases subject to use tax on

on individual, non-business items purchased

Line 34 and Line 35 – Tax Due/Overpaid Tax

the FTB income tax return.

for less than $1,000, then add the amounts and

If the amount on line 28 is larger than the

You may not report use tax for business purposes

report the total use tax on line 38.

amount on line 33, then the tax is larger than

on your California fiduciary income tax return if

the payments and credits. Subtract line 33 from

Example 3: The total price of the items you

you:

line 28. This is the amount of tax the estate or

purchased from out-of-state retailers that did

• Have a California seller’s permit.

trust owes before any voluntary contributions or

not collect use tax is $2,300, which includes a

• Are not required to hold a California seller’s

use tax.

$1,000 television, a $900 painting, and a $400

permit, but receive at least $100,000 in gross

table for your living room.

If the amount on line 28 is less than the amount

receipts.

on line 33, then the payments and credits are

• You may choose to calculate the use tax due

• Are otherwise required to be registered with

larger than the tax. Subtract line 28 from line 33.

on the total price of $2,300 using the Use Tax

the State Board of Equalization for sales or use

This is the amount of overpaid tax before any

Worksheet, or

tax purposes.

voluntary contributions or use tax.

• You may choose to calculate the use tax due

The Use Tax Worksheet and Use Tax Lookup

on the $1,000 price of the television using the

If the estate or trust must compute interest

Table on the next page will help you determine

Use Tax Worksheet and estimate your use tax

under the look-back method for completed

how much use tax to report. If you owe use

liability for the painting and table by using the

long-term contracts, get form FTB 3834,

tax but you do not report it on your California

Estimated Use Tax Lookup Table.

Interest Computation Under the Look-Back

fiduciary income tax return, you must report and

Method for Completed Long-Term Contracts.

pay the tax to the State Board of Equalization.

Include the amount of interest the estate or trust

For information on how to report use tax directly

owes on line 34 or the amount of interest to

to the State Board of Equalization, go to their

be credited or refunded to the organization on

website at boe.ca.gov and type “use tax” into the

line 35. Write “FTB 3834” on the dotted line to the

search box.

left of line 34 or line 35, whichever applies.

Page 10 Form 541 Booklet 2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12