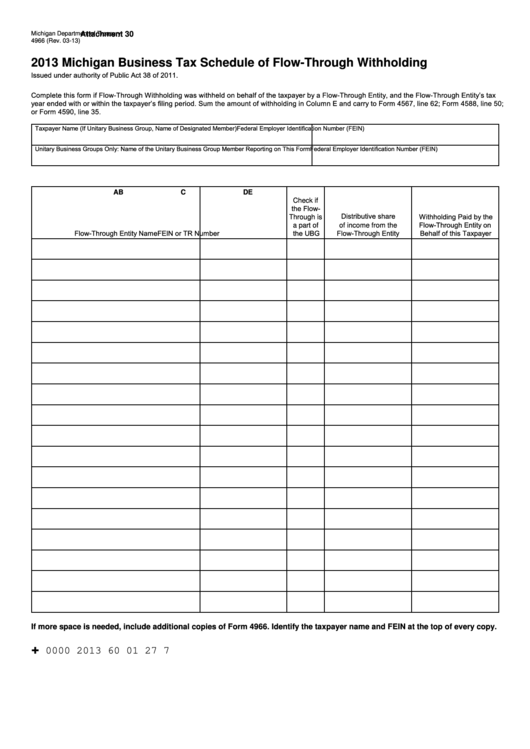

Form 4966 - Michigan Business Tax Schedule Of Flow-Through Withholding - 2013

ADVERTISEMENT

Michigan Department of Treasury

Attachment 30

4966 (Rev. 03-13)

2013 Michigan Business Tax Schedule of Flow-Through Withholding

Issued under authority of Public Act 38 of 2011.

Complete this form if Flow-Through Withholding was withheld on behalf of the taxpayer by a Flow-Through Entity, and the Flow-Through Entity’s tax

year ended with or within the taxpayer’s filing period. Sum the amount of withholding in Column E and carry to Form 4567, line 62; Form 4588, line 50;

or Form 4590, line 35.

Taxpayer Name (If Unitary Business Group, Name of Designated Member)

Federal Employer Identification Number (FEIN)

Unitary Business Groups Only: Name of the Unitary Business Group Member Reporting on This Form

Federal Employer Identification Number (FEIN)

A

B

C

D

E

Check if

the Flow-

Distributive share

Withholding Paid by the

Through is

Flow-Through Entity on

a part of

of income from the

Flow-Through Entity Name

FEIN or TR Number

the UBG

Flow-Through Entity

Behalf of this Taxpayer

If more space is needed, include additional copies of Form 4966. Identify the taxpayer name and FEIN at the top of every copy.

+

0000 2013 60 01 27 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3