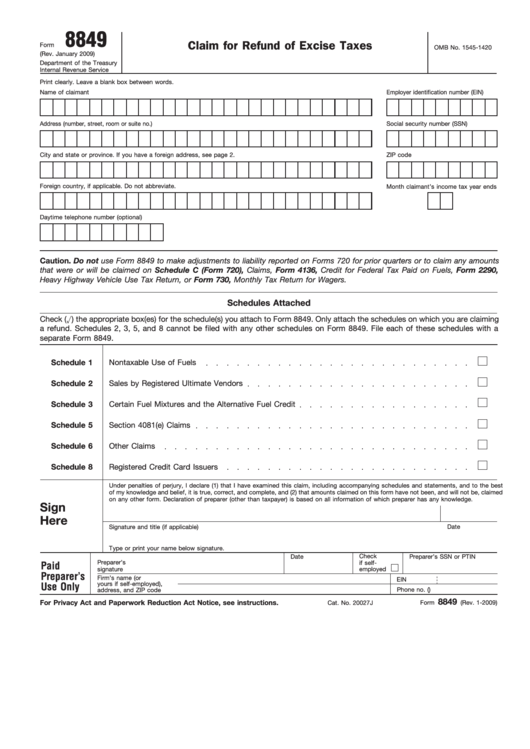

8849

Claim for Refund of Excise Taxes

Form

OMB No. 1545-1420

(Rev. January 2009)

Department of the Treasury

Internal Revenue Service

Print clearly. Leave a blank box between words.

Name of claimant

Employer identification number (EIN)

Address (number, street, room or suite no.)

Social security number (SSN)

City and state or province. If you have a foreign address, see page 2.

ZIP code

Foreign country, if applicable. Do not abbreviate.

Month claimant’s income tax year ends

Daytime telephone number (optional)

Caution. Do not use Form 8849 to make adjustments to liability reported on Forms 720 for prior quarters or to claim any amounts

that were or will be claimed on Schedule C (Form 720), Claims, Form 4136, Credit for Federal Tax Paid on Fuels, Form 2290,

Heavy Highway Vehicle Use Tax Return, or Form 730, Monthly Tax Return for Wagers.

Schedules Attached

Check ( ) the appropriate box(es) for the schedule(s) you attach to Form 8849. Only attach the schedules on which you are claiming

a refund. Schedules 2, 3, 5, and 8 cannot be filed with any other schedules on Form 8849. File each of these schedules with a

separate Form 8849.

Schedule 1

Nontaxable Use of Fuels

Schedule 2

Sales by Registered Ultimate Vendors

Schedule 3

Certain Fuel Mixtures and the Alternative Fuel Credit

Schedule 5

Section 4081(e) Claims

Schedule 6

Other Claims

Schedule 8

Registered Credit Card Issuers

Under penalties of perjury, I declare (1) that I have examined this claim, including accompanying schedules and statements, and to the best

of my knowledge and belief, it is true, correct, and complete, and (2) that amounts claimed on this form have not been, and will not be, claimed

on any other form. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

Signature and title (if applicable)

Date

Type or print your name below signature.

Check

Date

Preparer’s SSN or PTIN

Preparer’s

if self-

Paid

signature

employed

Preparer’s

Firm’s name (or

EIN

yours if self-employed),

Use Only

address, and ZIP code

Phone no. (

)

8849

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 20027J

Form

(Rev. 1-2009)

1

1 2

2 3

3 4

4