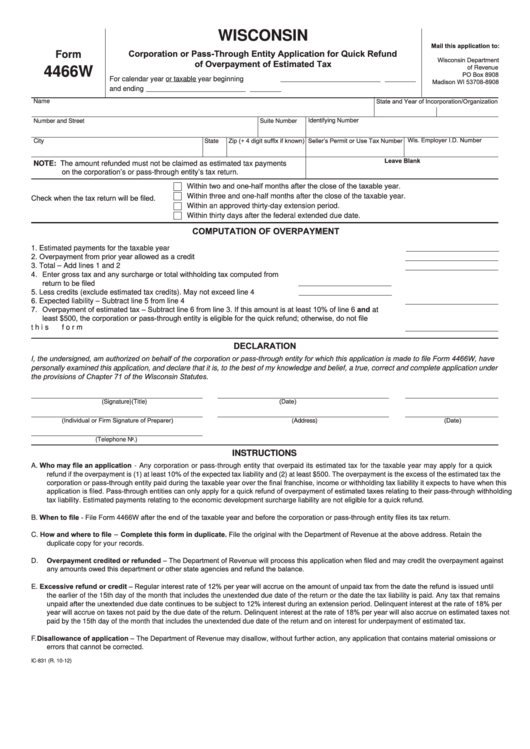

Form 4466w - Wisconsin Corporation Or Pass-Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax

ADVERTISEMENT

WISCONSIN

Form

of Revenue

4466W

For calendar year

or taxable year beginning

and ending

Name

Identifying Number

Number and Street

Suite Number

City

State

NOTE: The amount refunded must not be claimed as estimated tax payments

on the corporation’s or pass-through entity’s tax return.

Within three and one-half months after the close of the taxable year.

Within an approved thirty-day extension period.

Within thirty days after the federal extended due date.

1. Estimated payments for the taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3. Total – Add lines 1 and 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5. Less credits (exclude estimated tax credits). May not exceed line 4 . . . . . . 5

6. Expected liability – Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

at

this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

personally examined this application, and declare that it is, to the best of my knowledge and belief, a true, correct and complete application under

(Signature)

(Title)

(Address)

(Telephone No.)

INSTRUCTIONS

A.

- Any corporation or pass-through entity that overpaid its estimated tax for the taxable year may apply for a quick

refund if the overpayment is (1) at least 10% of the expected tax liability and (2) at least $500. The overpayment is the excess of the estimated tax the

tax liability. Estimated payments relating to the economic development surcharge liability are not eligible for a quick refund.

B.

C.

–

duplicate copy for your records.

E.

the earlier of the 15th day of the month that includes the unextended due date of the return or the date the tax liability is paid. Any tax that remains

paid by the 15th day of the month that includes the unextended due date of the return and on interest for underpayment of estimated tax.

F.

errors that cannot be corrected.

IC-831 (R. 10-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1